_1762916285NoFl4.jpg)

Lot 79 13 Frizell Crescent, Armidale NSW

Armidale, New England, NSW, 2350$ 735,000

Overview

Property ID: LA-17863

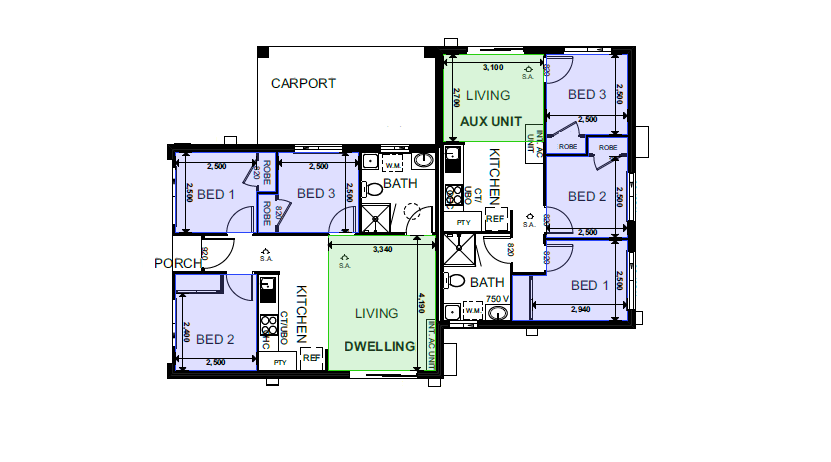

- Dual Occupancy

- Property Type

- 3+3

- Bedrooms

- 1+1

- Bathrooms

- 1

- Cars

- 131

Details

Updated on Oct 08, 2025 at 09:57 am

| Property Type: | Dual Occupancy |

|---|---|

| Price: | $ 735,000 |

| Land Price: | $ 210,000 |

| Build Price: | $ 525,000 |

| Gross Per Week: | $ 930 |

| Gross Per Annum: | $ 48,360 |

| Gross Yield: | 6.57% |

| Capital Growth 12 Months: | -1.22% |

| Capital Growth 10 Year Annualised: | 3.56% |

| Vacancy Rate: | 2.00% |

| Property Size: | 131 m2 |

| Land Area: | 588 m2 |

|---|---|

| Bedrooms: | 3+3 |

| Bathrooms: | 1+1 |

| Parking: | 1 |

| Title Status: | Titled |

| Property ID: | 17863 |

| SKU: | 1005 |

Description

This stunning dual occupancy property in Armidale offers a smart investment opportunity with strong rental returns and modern design. Featuring 3+3 bedrooms, 1+1 bathroom, and a functional layout, it is tailored for families or tenants seeking comfortable living. Positioned on a 588sqm lot with a 131sqm home, it combines practicality with rental appeal. With a titled lot and expected rent of $930 per week, investors can secure a high-yielding asset in a sought-after location.

Suburb profile:

Armidale is a thriving regional hub in New England, NSW, known for its education, healthcare, and employment opportunities. The suburb offers a balance of country charm and modern convenience, with a strong rental market driven by the University of New England and local industries. Armidale’s location provides excellent connectivity while maintaining an affordable cost of living. With ongoing demand for quality rental properties, the suburb continues to attract families, professionals, and investors alike.

Inclusions:

- Full Turn-Key Package

- Open-Plan Living

- High Quality Inclusions

- 6 Year Structure Guarantee

- Contemporary Colour Scheme

(This dual occupancy property presents a versatile investment with long-term growth potential, combining affordability with excellent rental returns.)

Investors looking to optimise land use and amplify their investment portfolio will find great value in Dual Occupancy Properties.

These properties cleverly accommodate two independent dwellings on a single parcel of land, effectively doubling the potential for rental income.

The design caters to a broad market, including extended families and tenants seeking spacious living options, thereby increasing the property's rental appeal.

The strategic configuration of these properties allows investors to capitalise on the growing demand for versatile housing solutions in both urban and suburban settings.

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 44,200

6.15%

5.65%

1.02%

Lot 706 Trafalgar Estate, Tamworth NSW

Tamworth, Tamworth, NSW, 2340$ 48,880

6.41%

3.56%

2.00%

Lot 303 40 Spearmount Drive, Armidale NSW

Armidale, Armidale, NSW, 2350$ 44,200

6.26%

5.65%

1.02%

Lot 611 21 Kiln Drive, Tamworth NSW

Tamworth, Tamworth, NSW, 2340$ 44,200

6.61%

5.65%

1.02%

Lot 610 19 Kiln Drive, Tamworth NSW

Tamworth, Tamworth, NSW, 2340Sold Listings

$ 57,720

5.01%

7.48%

1.14%

Lot 1243 Glamorous Street, Morayfield QLD

Morayfield, Moreton Bay Region , QLD, 4506$ 61,360

4.79%

7.62%

1.29%

Lot 9 Lacey Street, Camira QLD

Ipswich, QLD, 4300$ 57,200

6.70%

4.24%

0.93%

Lot A Austin Lakes, South Yunderup WA

Mandurah, WA, 6208$ 46,800

7.23%

5.03%

1.19%

Lot 11 Echo Beach, Mandurah WA

Mandurah, WA, 6210ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

_17623130443GJfk.jpg)

_1760408926gJ50A.jpg)

_17598783571Kaml.jpg)

_1758680457EfP8W.png)