_1739835983Dm3kj.jpg)

Overview

Property ID: LA-3715

- SDA

- Property Type

- 1+OOA

- Bedrooms

- 2

- Bathrooms

- 1

- Cars

- N/A

Details

Updated on Jan 22, 2025 at 10:38 am

| Property Type: | SDA |

|---|---|

| Price: | $ 725,000 |

| Land Price: | N/A |

| Build Price: | N/A |

| Gross Per Week: | $ 1,538 |

| Gross Per Annum: | $ 80,000 |

| Gross Yield: | 11.03% |

| Capital Growth 12 Months: | 17.65% |

| Capital Growth 10 Year Annualised: | 7.33% |

| Vacancy Rate: | 0.77% |

| Property Size: | N/A |

| Land Area: | N/A |

|---|---|

| Bedrooms: | 1+OOA |

| Bathrooms: | 2 |

| Parking: | 1 |

| Title Status: | March 2025 |

| Property ID: | 3715 |

| SKU: | 1034 |

Description

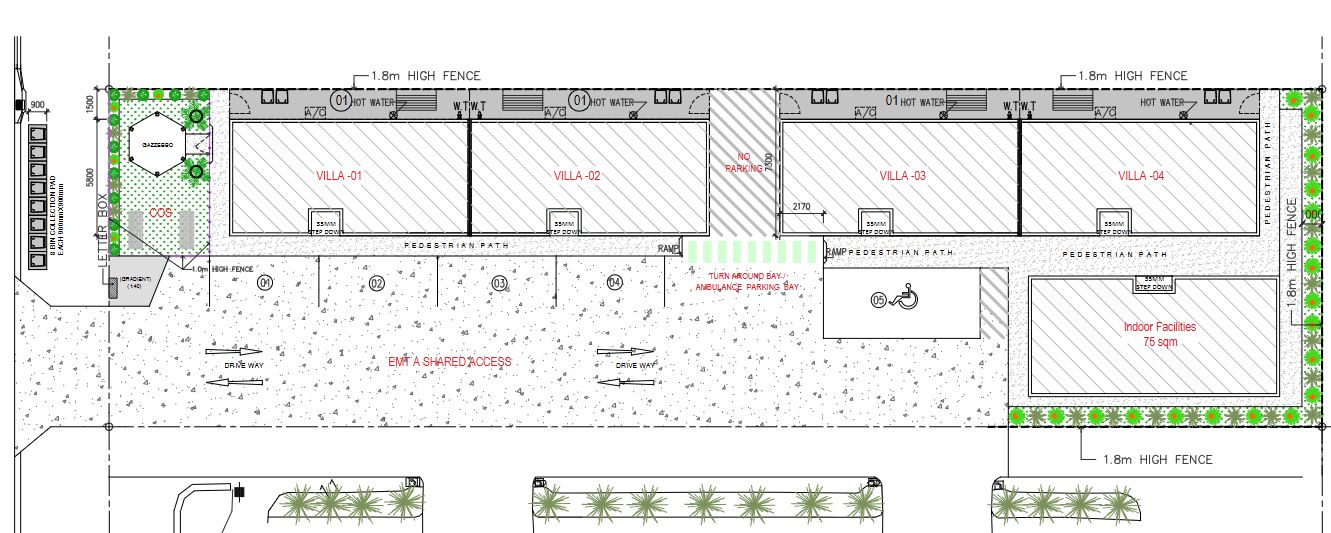

Beenleigh Villa Project

4 x Robust Villas (1 sold, 3 remaining)

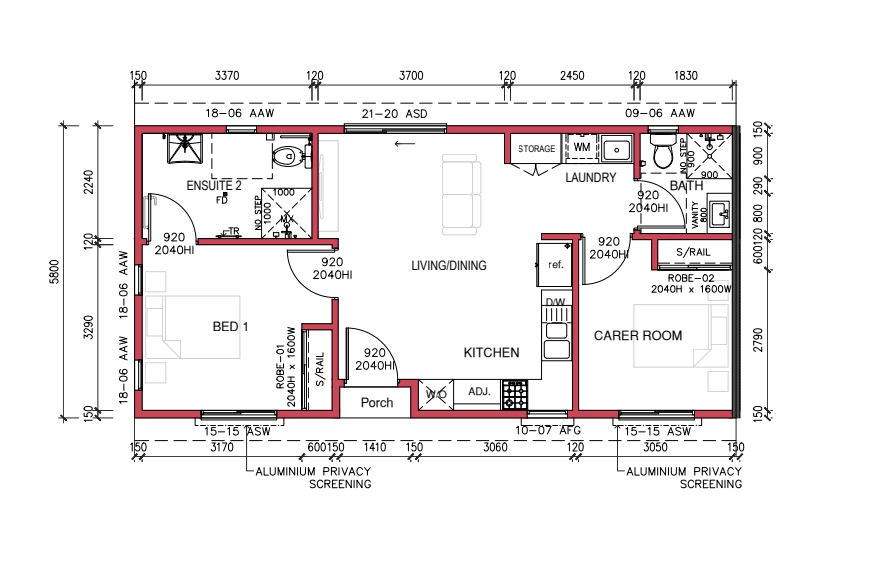

All Villas come with 2 Bed 2 Bathrooms which consist of 1 SDA resident plus OOA room for a carer if required.

Each Villa will receive approximately $85,000 – $100,000 P/A gross income.

11.00%-13.80% Gross Yield

Robust Villas consist of:

- 1 x Resident with ensuite per villa

- 1 Carers room plus extra powder room

- Community Area

- Dual Exit per villa

- Own courtyard

- Fully Self-Contained

- Villas will be strata-titled and sold separately.

- DA Approved, ETA Completion March/April 2025

- SDA Lease in place with one of Australia’s most reputable SDA Providers.

- Body Corp approximately $2500pa

- Management Fee 12% + GST

SDA – Specialist Disability Accommodation – Robust

SDA Accommodation:

An SDA home, which stands for Specialist Disability Accommodation, is a type of housing designed to meet the specific needs of individuals with significant disabilities who require high-level support and specialised accommodation. SDA aims to provide suitable housing options for participants with complex support needs.

Robust Housing:

Robust housing is designed to be strong and durable, reducing the need for repairs and maintenance. Its construction ensures safety for both residents and others. This type of housing is particularly suited for individuals who may need support in managing complex and challenging behaviours. The design takes into account the frequency and extent of potential property damage and provides solutions to mitigate it.

Benefits for Participants:

Improved Quality of Life: SDA homes are tailored to provide accessible and inclusive living environments, promoting independence, comfort, and safety for participants.

Benefits of SDA:

Cost Effectiveness: SDA aims to reduce the overall cost of disability support by providing suitable housing options. Offering appropriate accommodation can help prevent or minimise the need for more expensive, institutionalised care settings.

Benefits for the Community:

Inclusion and Accessibility: SDA homes create inclusive communities by providing accessible housing options for individuals with disabilities. This promotes social integration and enables participants to participate more fully in community life.

Benefits for Property Investors:

- Sustainable Financial Returns: Investing in SDA homes can provide property investors with stable, long-term rental income due to the ongoing demand for specialised accommodation for individuals with disabilities.

- Secure Tenancy: SDA homes often come with secure, long-term tenancy agreements, providing property investors greater stability and reduced vacancy rates.

- Ethical and Social Impact: Investing in SDA homes allows property investors to make a positive social impact by supporting individuals with disabilities and creating inclusive communities.

- Government Support: SDA provides financial incentives for property investors who choose to invest in these homes, offering potential financial benefits and enhancing the viability of such investments.

Overall, investing in SDA homes can offer property investors a combination of financial stability, social impact, and government support, making it an attractive investment option.

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Similar Listings

$ 31,200

3.88%

5.32%

2.22%

Lot 1020 - Ellery Estate - Wollert

Wollert, Melbourne, VIC, 3750$ 54,080

8.11%

6.16%

5.28%

Lot 5613 - Co-Living Jubilee Estate - Wyndham Vale

Wyndham Vale, Melbourne, VIC, 3024$ 24,440

4.28%

5.86%

3.04%

Lot 411 - Creekstone Estate - Tarneit

Tarneit, Melbourne, VIC, 3029$ 38,636

7.00%

5.55%

2.86%

Lot 1136 - Co-Living Springridge Estate - Wallan

Wallan, Shire of Mitchell, VIC, 3756Sold Listings

$ 42,328

5.97%

6.78%

4.55%

Lot S527 Bridge Road, Melton South VIC

Melbourne, VIC, 3338$ 44,044

5.95%

6.78%

4.55%

Lot S518 Nightjar Place, Melton South VIC

Melbourne, VIC, 3338$ 62,244

5.25%

8.11%

0.66%

Lot S23 Willow Estate, Lawnton, QLD

Moreton Bay, QLD, 4501$ 60,476

5.24%

8.11%

0.66%

Lot S20 Willow Estate, Lawnton, QLD

Moreton Bay, QLD, 4501ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

_1739321108JKJyl.jpg)

_1738201364ycj4i.jpg)

_1737586706bXRO5.jpg)

_1736985500LDN1C.jpg)

_1736206952XpKBO.jpg)