_176766512377GnS.png)

Lot 1162 Morningside QLD

Brisbane, QLD, 4170$ 1,779,900

Overview

Property ID: LA-19781

- Rooming House

- Property Type

- 5

- Bedrooms

- 5

- Bathrooms

- 2

- Cars

- 236

Details

Updated on Jan 05, 2026 at 09:39 am

| Property Type: | Rooming House |

|---|---|

| Price: | $ 1,779,900 |

| Land Price: | $ 1,150,000 |

| Build Price: | $ 629,900 |

| Gross Per Week: | $ 2,800 |

| Gross Per Annum: | $ 145,600 |

| Gross Yield: | 8.18% |

| Capital Growth 12 Months: | 9.02% |

| Capital Growth 10 Year Annualised: | 7.95% |

| Vacancy Rate: | 1.01% |

| Property Size: | 236 m2 |

| Land Area: | 422 m2 |

|---|---|

| Bedrooms: | 5 |

| Bathrooms: | 5 |

| Parking: | 2 |

| Title Status: | 'March 2026 |

| Property ID: | 19781 |

| SKU: | 1044 |

Description

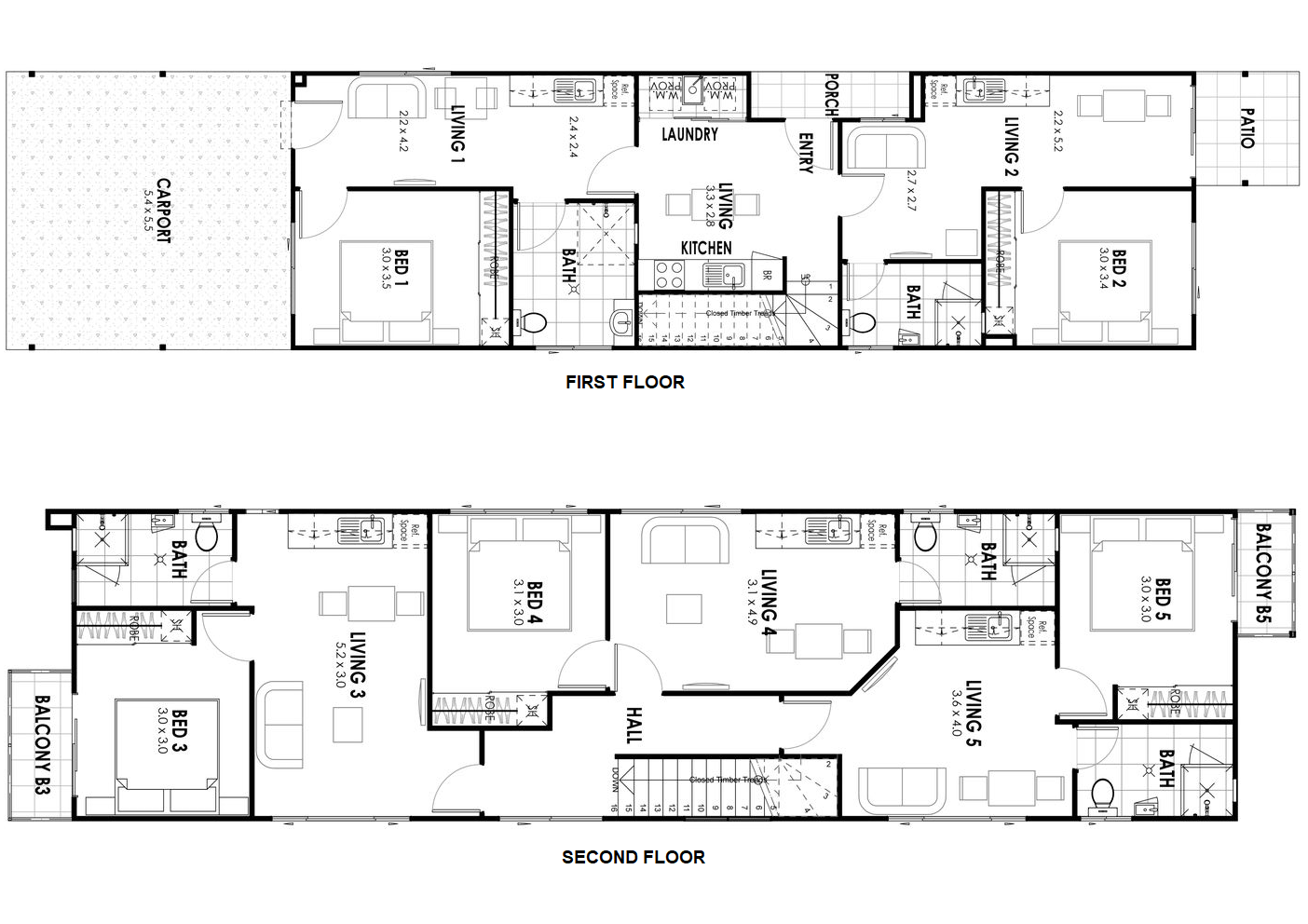

This modern rooming house property in Morningside offers five self-contained studios, each designed for comfort and privacy. It delivers strong rental performance with a projected weekly income of $2,800. The home spans 236 square meters on a 422 square meter allotment and includes two car spaces. The Glebe floor plan supports efficient use of space while remaining appealing to a wide tenant base.

Suburb profile:

Morningside is one of Brisbane’s most in-demand inner suburbs. It offers quick access to the CBD and a mix of lifestyle amenities that attract professionals and students. The suburb features public transport options, supermarkets and cafés within minutes. Residents enjoy a balance of urban convenience and suburban comfort. Its strong rental appeal continues to grow with rising demand for well located housing.

Inclusions:

- Truecore steel frame and trusses with a 50-year structural warranty

- Fixed price inclusion list

- Exclusive rooming house builder specifications

- 1 year material and workmanship guarantee from practical completion

- 4 colour selection schemes by an interior designer

- High density wall insulation to studio perimeter walls for acoustic performance

- Flush panel solid core entry door for each studio

- Quality Dulux 3 coat paint system

- 6 digital door locks with BLE and WiFi capability

- 1 reverse cycle split system air conditioner to each studio

- Emergency lighting and smoke alarms compliant with Class 1B

- 13kW photovoltaic solar system

- Hard wired smoke detectors with battery backup

- Sliding mirrored wardrobe doors with shelving and rail storage

- 2 ceiling fans per studio and 1 ceiling fan in the common area

- Barrier safety screens to all openable windows and sliding doors

- Tiled shower niche in all showers

- Concrete driveway, crossover, parking, patios, clothesline pads and paths

- Block out roller blinds to openable windows and vertical blinds to sliding doors

- 120 square meters of landscaping and 60 linear meters of fencing

- WELS rated chrome plated mixers

- ABS shower heads on chrome rails

- Vitreous china toilet suites in each bathroom

Furniture Pack Inclusions:

- Optional furniture package for $30,000 fully installed

- 5 LED smart TVs

- 5 refrigerator and freezer units

- 2 top load washing machines

- Studio bedroom and living furniture for all 5 studios

- Common area furniture and cleaning appliances

- All appliances, cooking items, crockery and cutlery

This rooming house property presents a strong yield and long term demand, making it a compelling investment choice in a high growth Brisbane location.

Single person households are rising across Australia. This strengthens the need for well designed individual living spaces. Rooming house properties meet this demand by providing private rooms with ensuite bathrooms and often personal living or kitchenette areas that resemble compact apartment style layouts.

These homes suit tenants who want affordable, flexible and low maintenance living. Many of these properties sit in suburban areas that offer quick access to transport, shopping and lifestyle hubs. They also appeal to professionals, students, remote workers and older singles who value convenience and privacy.

Investors benefit from high rental yields and low vacancy due to steady demand. Rooming houses tend to outperform traditional rental homes with better consistency of income and reduced turnover. Their locations often support strong long term capital growth due to proximity to transport, employment and education hubs.

Why are rooming houses attractive to investors?

- High demand for rooms ensures quick occupancy

- Rental yields often double suburb averages

- Diverse and stable tenant profiles

- Strong tax depreciation benefits

- Income stability even when one room becomes vacant

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 113,360

8.20%

7.40%

0.82%

Lot 1187 Oxley QLD

Oxley, Brisbane, QLD, 4075$ 113,360

8.16%

7.96%

0.67%

Lot 1188 Wellington Point QLD

Wellington Point, Brisbane, QLD, 4160$ 147,160

8.15%

7.43%

2.26%

Lot 1158 Indooroopilly QLD

Indooroopilly, Brisbane, QLD, 4068$ 126,360

8.57%

7.18%

0.59%

Lot 1184 Cleveland QLD

Cleveland, Brisbane East, QLD, 4163Sold Listings

$ 121,160

8.50%

7.52%

1.68%

Lot 1180 Coopers Plains QLD

Brisbane South, QLD, 4108$ 111,280

8.19%

8.39%

0.88%

Lot 1177 Caboolture QLD

Caboolture, Moreton Bay, QLD, 4510$ 116,280

8.03%

7.85%

0.82%

Lot 1174 Wynnum QLD

Wynnum, Brisbane, QLD, 4178$ 119,340

8.37%

7.62%

0.61%

Lot 1164 Boondall QLD

Boondall, Brisbane, QLD, 4034ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

_1764731815HUFUX.jpg)

_1764211036lHsm6.png)

_1762916285NoFl4.jpg)

_17623130443GJfk.jpg)

_1760408926gJ50A.jpg)