_17598783571Kaml.jpg)

Overview

Property ID: LA-16555

- Co-Living

- Property Type

- 5

- Bedrooms

- 5

- Bathrooms

- 2

- Cars

- 205

Details

Updated on Aug 21, 2025 at 05:06 pm

| Property Type: | Co-Living |

|---|---|

| Price: | $ 812,950 |

| Land Price: | $ 427,000 |

| Build Price: | $ 385,950 |

| Gross Per Week: | $ 1,268 |

| Gross Per Annum: | $ 65,936 |

| Gross Yield: | 8.11% |

| Capital Growth 12 Months: | -0.86% |

| Capital Growth 10 Year Annualised: | 6.78% |

| Vacancy Rate: | 4.55% |

| Property Size: | 205 m2 |

| Land Area: | 448 m2 |

|---|---|

| Bedrooms: | 5 |

| Bathrooms: | 5 |

| Parking: | 2 |

| Title Status: | Titled |

| Property ID: | 16555 |

| SKU: | 1029 |

Description

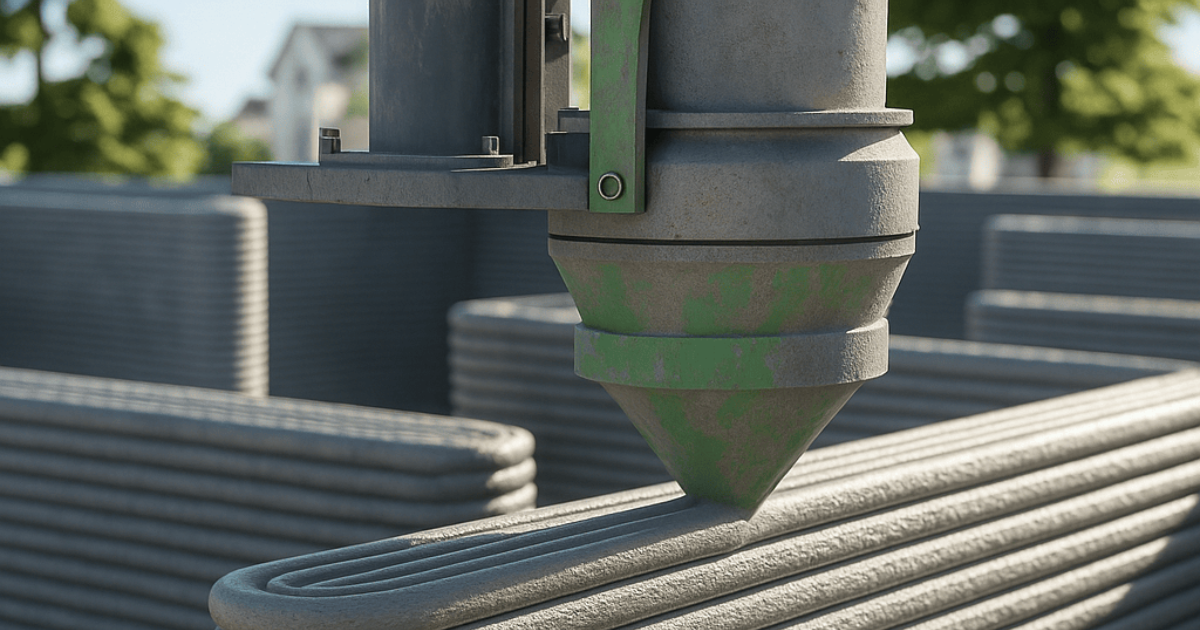

This co-living property at Lot 1414 Shelterbelt, Melton South VIC offers a high-yield investment opportunity in the growing Seventh Bend Estate. With 5 bedrooms, 5 bathrooms, and 2 car spaces, it’s designed for maximum tenant appeal and low vacancy risk. The home sits on a generous 448sqm block and features a 205sqm build, making it ideal for shared living. Title is due in January 2025, ensuring timely development and occupation.

Suburb profile:

Melton South is a rapidly developing suburb in Melbourne’s west, popular among families, young professionals, and investors. Its close proximity to the Melton Train Station, schools, and shopping centres makes it a well-connected and convenient area. The suburb continues to benefit from strong infrastructure investment and community expansion. Melton South offers affordable entry points with long-term capital growth potential, making it an attractive location for co-living developments.

Inclusions:

- Fixed site costs & connections

- Turnkey finish

- Colorbond roof

- 3-coat paint system throughout

- Stainless steel kitchen appliances

- LED downlights throughout

- Split system cooling

- Wall panel heaters to bedrooms

- Stone benchtops to kitchen, bathroom & ensuite

- Window locks & flyscreens

Site Inclusions - Site Works, Foundations & Connections:

- Fixed site costs

- Connections including NBN ready

Preliminary Inclusions:

- All council & developer requirements

- Energy rating assessment

- Preparation of plan of subdivision

Internal Inclusions:

- Split system cooling

- Panel heaters to all bedrooms

- LED lighting throughout

- Stone benchtops

External Inclusions:

- Colorbond roof

- Letterbox and clothesline

Landscaping Inclusions:

- Front and rear landscaping with garden bed

- Exposed aggregate driveway

Electrical Inclusions:

- LED downlights

- NBN provision

Appliance Inclusions:

- Stainless steel kitchen appliances

Energy Efficiency:

- 6-star energy rating

Warranties:

- 7-year structural warranty

This co-living property presents an outstanding opportunity for investors seeking strong rental yield, modern turnkey finish, and long-term growth in a high-demand location.

A co-living property is a type of shared accommodation that offers private bedrooms with ensuite bathrooms and communal spaces such as kitchens, living rooms, dining areas, laundry facilities and outdoor areas.

Co-living properties are designed to foster a sense of community, convenience and comfort among the residents, who can enjoy the benefits of having their own space as well as socialising with like-minded people.

A co-living property attracts tenants who are looking for an affordable, flexible and hassle-free living option that suits their lifestyle and needs.

Co-living tenants are typically young professionals, students, digital nomads, entrepreneurs, creatives and seniors who value convenience, connectivity and collaboration.

A co-living property offers benefits to an investor who is looking for a high-yield, low-risk and future-proof investment opportunity.

Co-living properties have a higher occupancy rate, lower vacancy rate and lower turnover rate than traditional rental properties, as they cater to the growing demand for affordable and flexible housing solutions in urban areas.

Co-living properties also have higher capital growth potential, as they are generally located in prime locations with access to transport, education, employment and entertainment hubs.

You can read more about Co-Living here: https://ausinvestmentproperties.com.au/blogs/co-living-the-future-of-australian-housing

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 42,120

8.00%

5.05%

2.45%

Lot 245 - Co-Living Northside Estate - Clyde No...

Clyde North , Melbourne, VIC, 3978$ 42,120

8.00%

5.05%

2.45%

Lot 245 - Co-Living Northside Estate - Clyde No...

Clyde North , Melbourne, VIC, 3978$ 38,948

6.00%

6.16%

5.28%

Lot 2445 - Co-living Windermere Estate - Mambourin

Mambourin, Melbourne, VIC, 3024$ 53,976

7.00%

5.05%

2.45%

Lot 3202 - Co-Living Smiths Lane - Clyde North

Clyde North, Melbourne, VIC, 3978Sold Listings

$ 52,000

6.83%

6.27%

0.67%

Lot S79 Davis Crescent, Mildura VIC

Mildura, VIC, 3500$ 46,800

7.06%

5.77%

1.75%

Lot S30 2 Valda Crescent, Darley VIC

Darley, Bacchus Marsh, VIC, 3340$ 62,400

8.82%

0.00%

15.77%

Lot 934 Skylark Drive, Winter Valley VIC

Winter Valley, Ballarat, VIC, 3358$ 39,988

5.88%

5.76%

1.46%

Lot 508 Rutledge Way, Ballarat VIC

Ballarat, Ballarat, VIC, 3350ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

/PSA-HR13.jpg)

_1758680457EfP8W.png)

_1756256563JRMCI.png)

_1755568176P3kHr.png)