How innovation in construction could reshape affordability, sustainability, and investment opportunities

Australia’s housing market faces ongoing challenges, rising construction costs, supply shortages, and an affordability crisis impacting both buyers and renters. For investors, these conditions can slow down projects, push up costs, and reduce yields. But an emerging innovation could help change the landscape, 3D printed homes.

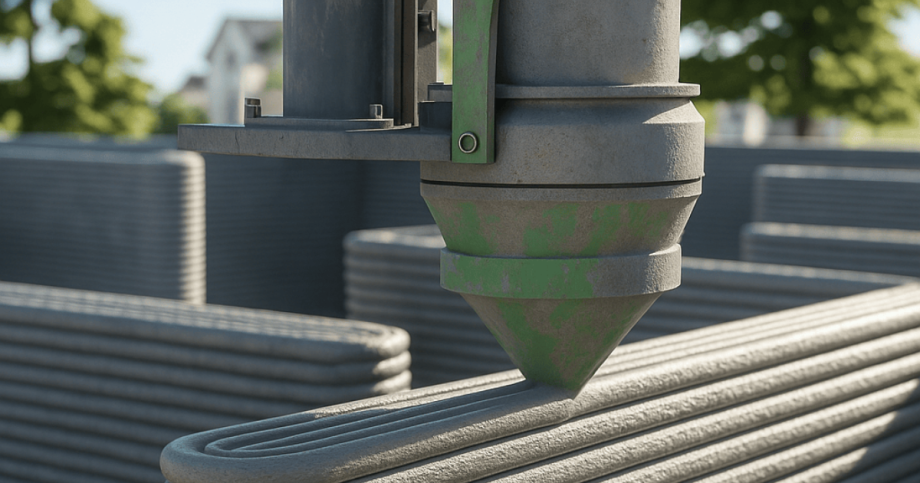

By combining cutting-edge technology with the practicality of concrete construction, 3D printed housing may soon deliver faster build times, significant cost savings, and improved energy efficiency. For property investors, this represents an opportunity worth understanding.

Faster Build Times and Lower Costs

One of the biggest hurdles for developers and investors today is the time it takes to bring a property to market. Traditional building methods can take many months, sometimes stretching beyond a year, especially when labour shortages or supply chain delays occur.

In contrast, 3D printed homes can be constructed in weeks, not months. Large-scale robotic printers extrude layers of specialised concrete, creating the entire structure quickly and with less manual labour. This means projects can be completed faster, enabling investors to generate rental income sooner.

Cost is another major advantage. With fewer workers on site, less material wastage, and more efficient construction, 3D printed housing offers the potential for lower build costs. For investors, this means improved margins, greater affordability in entry-level projects, and reduced financial risk from extended build times.

Stronger Living with Solid Concrete Walls

For tenants and owner-occupiers, the quality of a home is just as important as affordability. 3D printed homes typically use solid concrete walls, which offer a range of benefits that directly improve liveability and reduce running costs.

-

Noise reduction: Shared housing or co-living arrangements benefit from solid walls that significantly cut down on noise transfer. This makes these homes ideal for multi-tenant dwellings, a growing investment class in Australia.

-

Energy efficiency: Concrete provides excellent thermal insulation, keeping homes cooler in summer and warmer in winter. Lower heating and cooling requirements reduce tenant costs and make the property more appealing in a competitive rental market.

-

Durability: Unlike lightweight construction, concrete structures are highly resistant to fire, pests, and weather damage — offering longevity and reducing maintenance costs for investors.

These practical benefits position 3D printed homes not just as an affordable solution, but as a premium product for shared housing markets.

Meeting Australia’s Housing Needs

Australia’s housing shortage has been well documented. With migration increasing and demand far outpacing supply, the country needs faster, scalable, and more affordable building solutions. 3D printed housing has the potential to fill this gap whether through affordable single dwellings, co-living developments, or even social housing projects.

For investors, this opens up opportunities to participate in a sector aligned with both strong demand and government support. Early movers may also benefit from being ahead of the curve as councils, developers, and technology providers roll out pilot projects across the country.

What This Means for Investors

While 3D printed homes are still in their early stages in Australia, the global market has already shown proof of concept. From the United States to Europe, 3D printed residential communities are being built today.

For investors, this means:

-

Keeping an eye on emerging pilot projects that could offer early entry points.

-

Understanding how time and cost savings translate into higher yields and quicker cash flow.

-

Exploring how shared housing models (dual occupancy, co-living, rooming houses) might integrate with 3D printed technology for scalable, long-term investment growth.

While widespread adoption may take time, investors who educate themselves now will be ready to act when opportunities become mainstream.

The question isn’t just whether 3D printed homes are possible they already exist. The real question is how quickly Australia will adopt this innovation, and how investors can position themselves to benefit. With faster builds, lower costs, and high-quality concrete walls offering thermal and acoustic advantages, 3D printed homes could be part of the solution to Australia’s housing shortage.

For forward-thinking investors, this emerging technology represents not just a glimpse of the future, but a potential pathway to sustainable, profitable property investing.

Visit our website www.ausinvestmentproperties.com.au to view all our available investment properties.

_17701746679NQAl-card.jpg)

_176766512377GnS-card.png)

_1764211036lHsm6-card.png)

_1762916285NoFl4-card.jpg)

_17623130443GJfk-card.jpg)

_1760408926gJ50A-card.jpg)

_1771381544bNgSb.jpg)

_1770677325GS4sO.jpg)

_17701746679NQAl.jpg)

_176766512377GnS.png)

_1764731815HUFUX.jpg)

_1764211036lHsm6.png)