_17598783571Kaml.jpg)

Lot 207 21 Gordon St, Calala NSW

Calala, Armidale, NSW, 2340$ 822,130

Overview

Property ID: LA-16410

- Dual Occupancy

- Property Type

- 3+3

- Bedrooms

- 1+1

- Bathrooms

- 2

- Cars

- 131

Details

Updated on Sep 01, 2025 at 10:57 am

| Property Type: | Dual Occupancy |

|---|---|

| Price: | $ 822,130 |

| Land Price: | $ 250,000 |

| Build Price: | $ 572,130 |

| Gross Per Week: | $ 930 |

| Gross Per Annum: | $ 48,360 |

| Gross Yield: | 5.88% |

| Capital Growth 12 Months: | 3.77% |

| Capital Growth 10 Year Annualised: | 5.65% |

| Vacancy Rate: | 1.02% |

| Property Size: | 131 m2 |

| Land Area: | 842 m2 |

|---|---|

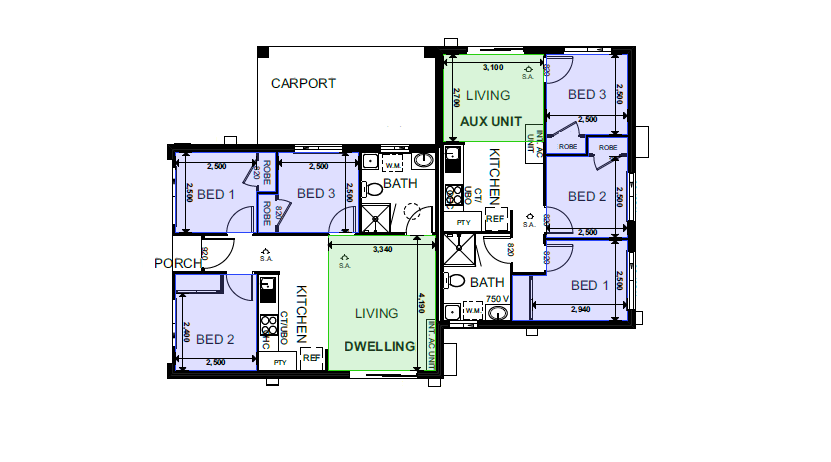

| Bedrooms: | 3+3 |

| Bathrooms: | 1+1 |

| Parking: | 2 |

| Title Status: | Titled |

| Property ID: | 16410 |

| SKU: | 1005 |

Description

This dual occupancy property at Lot 207, 21 Gordon St, Calala NSW comprises two self-contained 3-bedroom, 1-bathroom residences with 1 living area and shared off-street parking. Set on an 842sqm block with a total build size of 131sqm, this full turn-key investment is designed for investors seeking reliable dual income and minimal ongoing maintenance.

Suburb profile:

Calala is a residential suburb of Armidale in northern New South Wales, offering a mix of established homes and new developments. With access to schools, shopping, and transport, the area is well-suited to families and tenants looking for affordable regional living. Calala benefits from proximity to the University of New England and the broader Armidale economy, supporting long-term rental demand.

Inclusions:

- Full Turn-Key Package

- Open-Plan Living

- High Quality Inclusions

- 6 Year Structure Guarantee

- Contemporary Colour Scheme

This dual occupancy property in Calala delivers a strong rental yield and a strategic investment opportunity in a growing regional market.

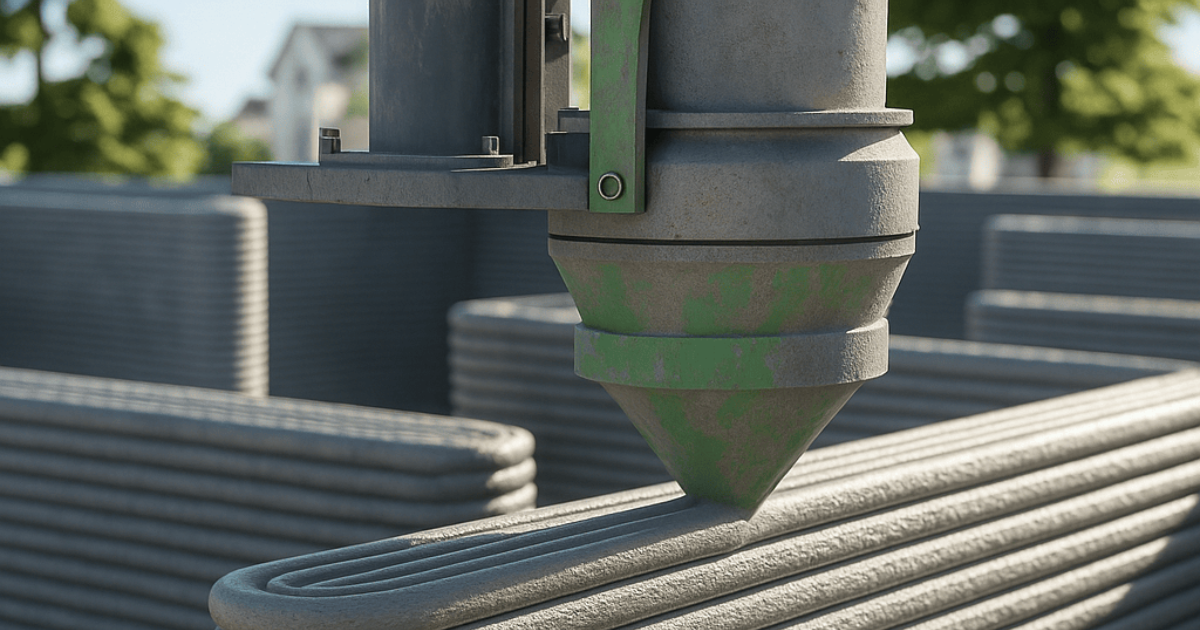

Investors looking to optimise land use and amplify their investment portfolio will find great value in Dual Occupancy Properties.

These properties cleverly accommodate two independent dwellings on a single parcel of land, effectively doubling the potential for rental income.

The design caters to a broad market, including extended families and tenants seeking spacious living options, thereby increasing the property's rental appeal.

The strategic configuration of these properties allows investors to capitalise on the growing demand for versatile housing solutions in both urban and suburban settings.

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 62,400

6.1%

6.20%

0.24%

Lot 77 Homestead Road, Rosenthal Heights QLD (M...

Rosenthal Heights, Southern Downs, QLD, 4370$ 62,400

6.2%

6.20%

0.24%

Lot 74 Gibson Road, Rosenthal Heights QLD (Mode...

Southern Downs, QLD, 4370$ 62,400

6.2%

6.20%

0.24%

Lot 64 Gibson Road, Rosenthal Heights QLD (Mode...

Rosenthal Heights, Southern Downs, QLD, 4370$ 51,480

4.68%

7.48%

1.14%

Lot 14 Silkyoak Road, Morayfield QLD

Morayfield, Moreton Bay, QLD, 4506Sold Listings

$ 53,560

5.23%

8.43%

0.74%

Lot S75 Birdie Crescent, Gympie QLD

Gympie, Gympie, QLD, 4570$ 53,560

5.41%

9.35%

0.56%

Lot S3 Claydon Street, Dinmore QLD

Ipswich, QLD, 4303$ 53,560

5.41%

9.35%

0.56%

Lot S1 Claydon Street, Dinmore QLD

Ipswich, QLD, 4303$ 53,560

5.41%

8.09%

1.00%

Lot S236 Lilypilly, Collingwood Park QLD

Ipswich, QLD, 4301ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

/Lot-14.jpg)

/BT-DO-HR6.jpg)

/BT-DO-HR5.jpg)

_1758680457EfP8W.png)

_1756256563JRMCI.png)

_1755568176P3kHr.png)