_1731370023fXN7O.jpg)

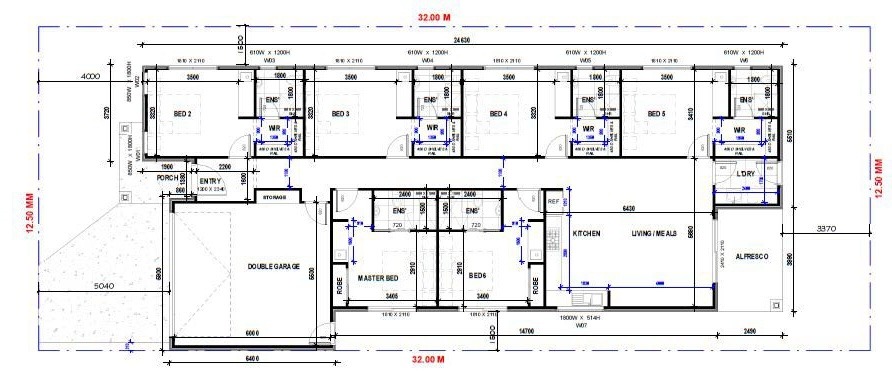

Lot 33 Ronald Street, Hillview, Bacchus Marsh VIC

Bacchus Marsh, VIC, 3340$ 954,900

Overview

Property ID: LA-3887

- House and Land

- Property Type

- 6

- Bedrooms

- 6

- Bathrooms

- 2

- Cars

- 241

Details

Updated on Sep 30, 2024 at 12:09 am

| Property Type: | House and Land |

|---|---|

| Price: | $ 954,900 |

| Land Price: | $ 335,000 |

| Build Price: | $ 619,900 |

| Gross Per Week: | $ 1,920 |

| Gross Per Annum: | $ 99,840 |

| Gross Yield: | 10.46% |

| Capital Growth 12 Months: | -4.48% |

| Capital Growth 10 Year Annualised: | 5.70% |

| Vacancy Rate: | 1.90% |

| Property Size: | 241 m2 |

| Land Area: | 448 m2 |

|---|---|

| Bedrooms: | 6 |

| Bathrooms: | 6 |

| Parking: | 2 |

| Title Status: | Titled |

| Property ID: | 3887 |

| SKU: | 2000 |

Description

Co-Living Housing

A co-living property is a type of shared accommodation that offers private bedrooms with ensuite bathrooms and communal spaces such as kitchens, living rooms, dining areas, laundry facilities and outdoor areas.

Co-living properties are designed to foster a sense of community, convenience and comfort among the residents, who can enjoy the benefits of having their own space as well as socialising with like-minded people.

A co-living property attracts tenants who are looking for an affordable, flexible and hassle-free living option that suits their lifestyle and needs.

Co-living tenants are typically young professionals, students, digital nomads, entrepreneurs, creatives and seniors who value convenience, connectivity and collaboration.

A co-living property offers benefits to an investor who is looking for a high-yield, low-risk and future-proof investment opportunity.

Co-living properties have a higher occupancy rate, lower vacancy rate and lower turnover rate than traditional rental properties, as they cater to the growing demand for affordable and flexible housing solutions in urban areas.

Co-living properties also have higher capital growth potential, as they are generally located in prime locations with access to transport, education, employment and entertainment hubs.

You can read more about Co-Living here: https://latitudeproperty.com.au/co-living-the-future-of-australian-housing/

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 36,920

5.26%

5.55%

0.78%

Lot 220 - Silverwood Estate - Traralgon - AUD 7...

Traralgon, Gippsland, VIC, 3844$ 36,920

5.42%

5.55%

0.78%

Lot 220 - Silverwood Estate - Traralgon - AUD 7...

Traralgon, Gippsland, VIC, 3844$ 39,000

5.62%

10.00%

0.64%

Lot 3 - Co-Living 136 Woodford Road - Elizabeth...

Elizabeth North, Adelaide, SA, 5113$ 39,780

5.45%

10.00%

0.64%

Lot 3 - Co-Living Fordingbridge Road - Davoren ...

Davoren Park, Adelaide, SA, 5113Sold Listings

$ 51,480

4.92%

7.63%

0.88%

Lot 9 Echo Estate, Upper Coomera QLD (Co-living)

City of Gold Coast, QLD, 4209$ 52,000

7.56%

6.45%

1.45%

Lot 2236 Midford Ave, Werribee VIC

Melbourne, VIC, 3030$ 39,000

5.57%

0.00%

8.22%

Lot 464 Hackamore St, Fraser Rise VIC

Melton, VIC, 3336$ 39,000

5.20%

6.34%

4.22%

Lot 319 Arianna St, Wyndham Vale VIC

Melbourne, VIC, 3024ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

_1730769795hVnz2.jpg)

_1730162334313hH.jpg)

-(1)_1729729790xZH4a.jpg)

_1729556020zIwJi.jpg)