_17598783571Kaml.jpg)

Lot 4 Sibley Street, Werribee VIC

Melbourne, VIC, 3030$ 1,406,200

Overview

Property ID: LA-15973

- Rooming House

- Property Type

- 9

- Bedrooms

- 9

- Bathrooms

- 2

- Cars

- 295

Details

Updated on Aug 11, 2025 at 12:31 pm

| Property Type: | Rooming House |

|---|---|

| Price: | $ 1,406,200 |

| Land Price: | $ 560,000 |

| Build Price: | $ 846,200 |

| Gross Per Week: | $ 2,880 |

| Gross Per Annum: | $ 149,760 |

| Gross Yield: | 10.65% |

| Capital Growth 12 Months: | 2.92% |

| Capital Growth 10 Year Annualised: | 6.38% |

| Vacancy Rate: | 1.66% |

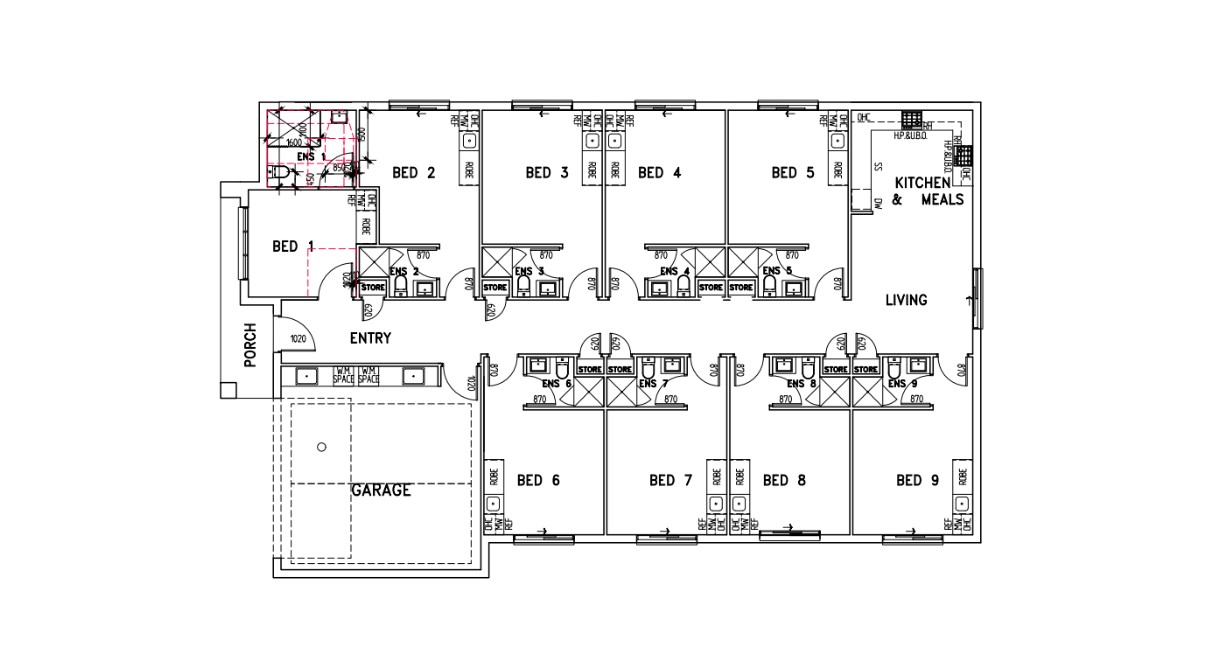

| Property Size: | 295 m2 |

| Land Area: | 693 m2 |

|---|---|

| Bedrooms: | 9 |

| Bathrooms: | 9 |

| Parking: | 2 |

| Title Status: | Titled |

| Property ID: | 15973 |

| SKU: | 1053 |

Description

This rooming house property in Werribee offers a rare opportunity to secure a premium 9-bedroom investment with high rental yield potential. Each room is designed for privacy and functionality, complemented by two car spaces and multiple living zones. Located on a spacious 693 sqm titled block, this is a fully turnkey investment solution suited for long-term value and strong tenant appeal in a rapidly growing suburb.

Suburb profile:

Werribee is a thriving suburb located between Melbourne and Geelong, celebrated for its established amenities and continuous development. Known for its proximity to major infrastructure like the Werribee Mercy Hospital, Pacific Werribee Shopping Centre, and reputable schools, it attracts both families and professionals. With excellent transport links via rail and freeway, Werribee offers convenience, lifestyle, and investment potential. The area has seen consistent population growth, making it a compelling choice for property investors.

Furniture Pack Inclusions:

- Bedroom furnishings including bed, mattress, study desk and chair

- Living area essentials

- Dining and common area furniture

- Appliances and window furnishings

- Cutlery, crockery, linen, cleaning equipment and décor

Energy Efficiency:

- 6-star energy rating

Warranties:

- 10-year structural warranty

- Rental assurance and defect cover (where applicable)

This rooming house property provides investors with a high-yield, fully packaged opportunity in an area of high demand and ongoing growth.

Single-person households are on the rise, accounting for a significant 25% of all households in Australia. This trend shows no signs of slowing down, and experts project a continued growth in single-person households, reaching an estimated 3 to 3.5 million over the next two decades. This surge underscores the increasing demand for housing options tailored to individual occupants.

Rooming house properties represent a form of shared accommodation, offering private bedrooms with ensuite bathrooms, and often including living and kitchenette facilities akin to a compact, one-bedroom unit or apartment. These properties appeal to tenants seeking affordable, adaptable, and hassle-free living arrangements that align with their lifestyles and requirements.

Many rooming houses are strategically situated in suburban areas, providing proximity to transportation, shopping centers, restaurants, cafes, and community hubs—making them an enticing choice for tenants.

Typical rooming house tenants encompass young professionals, students, digital nomads, entrepreneurs, creatives, and seniors who prioritize convenience, connectivity, and collaboration.

For investors, rooming house properties offer a compelling value proposition. They present a high-yield, low-risk, and forward-looking investment opportunity. Rooming house properties consistently maintain higher occupancy rates, lower vacancy rates, and reduced turnover compared to traditional rentals. This aligns with the burgeoning demand for affordable and flexible housing solutions in urban settings.

Additionally, rooming house properties often boast higher capital growth potential, given their prime locations with access to transportation, education, employment, and entertainment hubs.

Why are rooming houses so attractive to investors?

- High Demand: Rooms are in high demand, ensuring quick occupancy.

- Higher Yields: Often double compared to the suburb average.

- Diverse Tenant Base: Young professionals and older singles generally seek this accommodation category.

- Tax Depreciation: Benefits from fixtures and fittings.

- Income Security: Steady income flow even when one tenant moves out.

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 83,200

8.49%

5.86%

3.04%

Lot 1129 Velvet Way, Tarneit VIC

Tarneit, Melbourne, VIC, 3029$ 154,440

10.15%

6.38%

1.66%

Lot 38B Nantilla Crescent, Werribee VIC

Werribee, Melbourne, VIC, 3030$ 83,200

9.16%

4.73%

2.46%

Lot 1318 Dunken Street, Armstrong Creek VIC

Armstrong Creek, Geelong, VIC, 3217$ 168,480

11.17%

5.86%

3.04%

Lot 33 Willmott Drive, Hoppers Crossing VIC

Hoppers Crossing, Melbourne, VIC, 3029Sold Listings

$ 112,580

8.40%

7.54%

1.59%

Lot 1139 Darra QLD

Brisbane, QLD, 4076$ 83,200

10.51%

6.27%

0.67%

Lot 5 Jennys way, Mildura VIC (5 beds)

Mildura, Mildura, VIC, 3500$ 81,900

9.13%

5.99%

0.78%

Lot 630 Ribolla Way, Sunbury VIC

Sunbury, Melbourne, VIC, 3429$ 98,800

10.46%

6.27%

0.67%

Lot 79 Davis Crescent, Mildura VIC (6 beds)

Mildura, VIC, 3500ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

_1752053611WiX7M.jpg)

_1752053611SyYxx.jpg)

_175205361122fe6.jpg)

_1758680457EfP8W.png)

_1756256563JRMCI.png)

_1755568176P3kHr.png)