_1754959266HOub5.png)

Overview

Property ID: LA-12877

- Duplex

- Property Type

- 4+4

- Bedrooms

- 3+3

- Bathrooms

- 1+1

- Cars

- 350

Details

Updated on Jun 17, 2025 at 09:41 pm

| Property Type: | Duplex |

|---|---|

| Price: | $ 1,552,690 |

| Land Price: | $ 725,000 |

| Build Price: | $ 827,690 |

| Gross Per Week: | $ TBA |

| Gross Per Annum: | $ TBA |

| Gross Yield: | TBA% |

| Capital Growth 12 Months: | 5.88% |

| Capital Growth 10 Year Annualised: | 7.39% |

| Vacancy Rate: | 0.68% |

| Property Size: | 350 m2 |

| Land Area: | 708 m2 |

|---|---|

| Bedrooms: | 4+4 |

| Bathrooms: | 3+3 |

| Parking: | 1+1 |

| Title Status: | Titled |

| Property ID: | 12877 |

| SKU: | 1001 |

Description

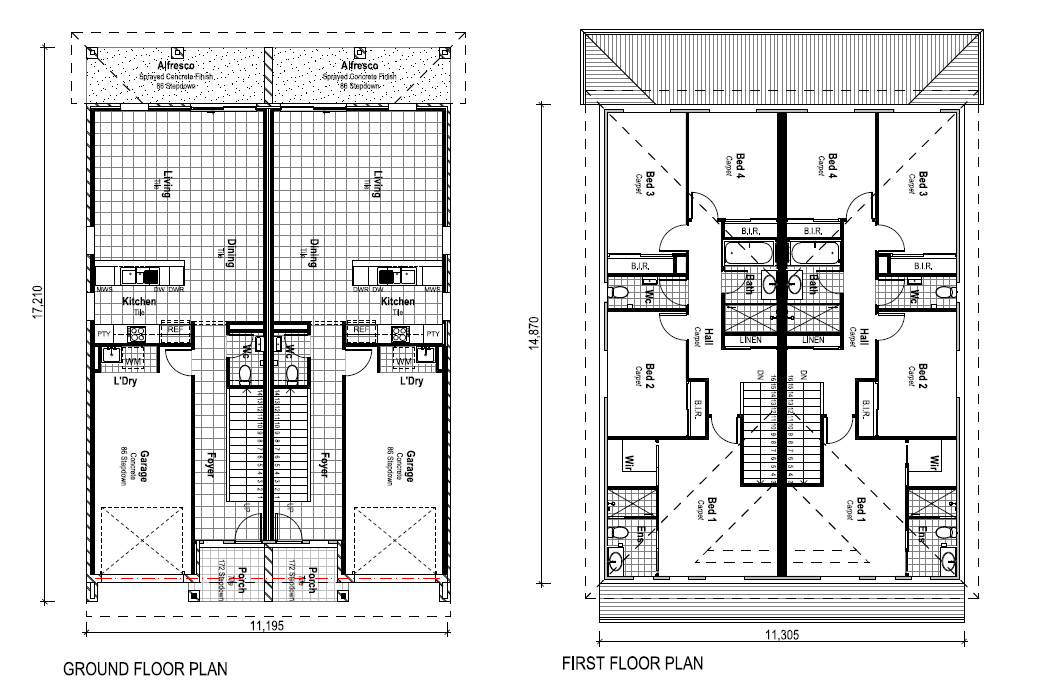

This duplex property located in Crangan Bay NSW, offers a full turnkey house and land package with fixed pricing. It features a total building area of 350m2 and sits on a 708 m2 block. Designed with dual living in mind, the layout includes 4+4 bedrooms, 3+3 bathrooms, and 1+1 car spaces across both residences.

Suburb profile:

Crangan Bay is a peaceful and emerging suburb on the Central Coast of New South Wales, surrounded by natural bushland and close to Lake Macquarie. The area is experiencing steady residential development and appeals to both families and investors seeking tranquillity and long-term growth potential. It is within convenient reach of beaches, major highways, and town centres like Swansea and Lake Haven, offering both lifestyle and accessibility.

This duplex property in Crangan Bay presents a spacious and well-equipped investment opportunity with modern inclusions and fixed pricing, suitable for dual rental income or multi-generational living.

Duplex Properties offers a unique investment avenue that combines aesthetic appeal with functional design, in most cases presenting two mirror-image living under one roofline.

This arrangement not only maximizes land use but also provides investors with the opportunity to generate substantial rental income from two separate tenancies.

The mirrored layout ensures equality in living conditions, making each unit an attractive option for prospective tenants.

Duplexes are particularly appealing for their ability to offer substantial living spaces, representing standalone homes, which can significantly enhance the property's market value and attract a wide range of tenants.

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 32,240

3.91%

6.40%

1.35%

Lot S224-A New Road, Burpengary QLD

Moreton Bay, QLD, 4505$ 32,240

3.91%

6.40%

1.35%

Lot S224-B New Road, Burpengary QLD

Moreton Bay, QLD, 4505$ 57,200

6.50%

5.65%

1.02%

Lot 221 19 Peppercress Crt, Moore Creek NSW

Moore Creek, Tamworth, NSW, 2340$ 59,800

4.61%

8.41%

1.53%

Lot 529/23 Brandy Way, Bellbird NSW

Cessnock, NSW, 2325Sold Listings

$ 31,200

4.11%

7.48%

1.14%

Lot S82-B New Road, Morayfield QLD

Morayfield, Moreton Bay, QLD, 4506$ 36,400

4.18%

8.09%

1.00%

Lot S220-B Lilypilly Street, Collingwood Park QLD

Collingwood Park, Ipswich, QLD, 4301$ 31,200

4.05%

7.48%

1.14%

Lot S82-A New Road, Morayfield QLD

Morayfield, Moreton Bay, QLD, 4506$ 49,920

4.66%

6.28%

0.54%

Lot 47 Thiess Street, Drayton QLD 4350

Toowoomba, QLD, 4350ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

.jpg)

.jpg)

.jpg)

_1753150958JS0u1.png)

_1752115352WpaHL.jpg)

_1751940993PbDjZ.jpg)

_1751333432LuNFZ.jpg)

_1748483094kMBGy.jpg)