_17598783571Kaml.jpg)

Overview

Property ID: LA-17816

- SMSF Single Contract

- Property Type

- 3+1

- Bedrooms

- 3+1

- Bathrooms

- 1+1

- Cars

- 0

Details

Updated on Sep 26, 2025 at 10:29 am

| Property Type: | SMSF Single Contract |

|---|---|

| Price: | $ 1,300,000 |

| Land Price: | N/A |

| Build Price: | N/A |

| Gross Per Week: | $ 2,827 |

| Gross Per Annum: | $ 147,000 |

| Gross Yield: | 11.31% |

| Capital Growth 12 Months: | 17.65% |

| Capital Growth 10 Year Annualised: | 7.33% |

| Vacancy Rate: | 0.77% |

| Property Size: | 0 m2 |

| Land Area: | 480 m2 |

|---|---|

| Bedrooms: | 3+1 |

| Bathrooms: | 3+1 |

| Parking: | 1+1 |

| Title Status: | Completed |

| Property ID: | 17816 |

| SKU: | 1062 |

Description

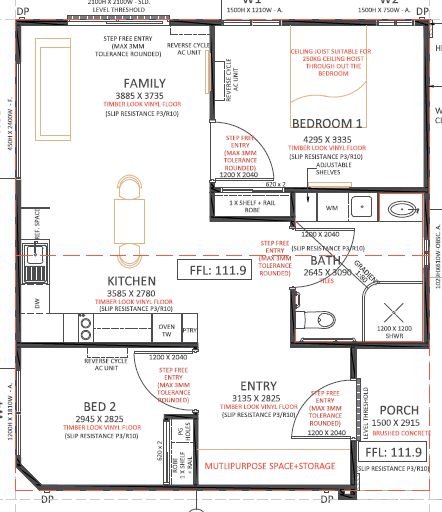

This stunning SDA - Robust property in Yarrabilba has been thoughtfully designed to provide safe, durable, and comfortable accommodation. With dual villas under one roofline, the home offers 4 bedrooms, 4 bathrooms, and 2 car parks, ensuring privacy and accessibility for all residents. Spacious layouts, resilient finishes, and accessible features create a secure living environment for individuals requiring robust housing solutions. Positioned in a growing corridor, it presents both lifestyle benefits and a strong investment opportunity.

Suburb profile:

Yarrabilba is one of South-East Queensland's fastest-growing masterplanned communities, offering a family-friendly environment with modern amenities. Residents enjoy access to schools, parks, shopping centres, and health services, all within a short drive. The suburb is well connected to Logan, Brisbane, and the Gold Coast, making it attractive to both homeowners and investors. With its rapid infrastructure development, Yarrabilba is positioned for continued growth and long-term capital appreciation.

Inclusions:

- Spacious 480 sqm block

- 4 bedrooms and 4 bathrooms across dual villas

- Separate alfresco outdoor patio for each villa

- Vinyl flooring throughout

- Accessible bathrooms

- Air conditioning throughout

- Single garage for each villa

- Low-maintenance gardens

This SDA - Robust property combines long-term durability with a strong rental income stream, offering both financial stability and meaningful social impact for investors.

SDA - Robust

SDA Accommodation: An SDA home, which stands for Specialist Disability Accommodation, is a type of housing designed to meet the specific needs of individuals with significant disabilities who require high-level support and specialised living environments. SDA is designed to provide suitable housing options for people with complex support needs.

Robust Housing: This housing option is designed to be resilient and durable, providing a safe and low-stimulus environment for individuals with complex behavioural needs. Features often include high-impact wall linings, secure windows, and layouts that reduce the risk of harm to occupants and carers.

Benefits for Participants: Improved Safety and Stability: SDA Robust homes provide secure and calm environments, enabling participants to feel safe and supported in their daily lives.

Benefits: Cost Effectiveness: By reducing incidents and damage, robust housing can lower ongoing maintenance and support costs, while providing a more sustainable living arrangement.

Benefits for the Community: Enhanced Community Integration: Robust housing allows individuals to live safely within the community while minimising disruptions and promoting stability for neighbours and support networks.

Benefits for Property Investors:

- Sustainable Financial Returns: Robust SDA homes maintain high occupancy due to their specialised design and consistent demand.

- Secure Tenancy: Long-term tenancy agreements provide stable rental income and reduce vacancy risks.

- Ethical and Social Impact: Investors contribute to providing safe housing for individuals with complex needs, improving quality of life and community wellbeing.

- Government Support: Investment in Robust SDA homes may qualify for government-backed incentives, enhancing project profitability.

Overall, investing in Robust SDA homes offers property investors a balance of financial reliability, social responsibility, and supportive government frameworks, making it a strong and meaningful investment choice.

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 42,120

8.00%

5.05%

2.45%

Lot 245 - Co-Living Northside Estate - Clyde No...

Clyde North , Melbourne, VIC, 3978$ 60,320

5.16%

7.18%

0.29%

Lot 925 - Cameron Grove Estate - Cameron Park

Cameron Park, City of Lake Macquarie, NSW, 2285$ 42,120

8.00%

5.05%

2.45%

Lot 245 - Co-Living Northside Estate - Clyde No...

Clyde North , Melbourne, VIC, 3978$ 60,320

5.16%

7.18%

0.29%

Lot 919 - Cameron Grove Estate - Cameron Park

Cameron Park, City of Lake Macquarie, NSW, 2285Sold Listings

$ 53,560

5.23%

8.43%

0.74%

Lot S75 Birdie Crescent, Gympie QLD

Gympie, Gympie, QLD, 4570$ 52,000

6.83%

6.27%

0.67%

Lot S79 Davis Crescent, Mildura VIC

Mildura, VIC, 3500$ 53,560

5.41%

9.35%

0.56%

Lot S3 Claydon Street, Dinmore QLD

Ipswich, QLD, 4303$ 53,560

5.41%

9.35%

0.56%

Lot S1 Claydon Street, Dinmore QLD

Ipswich, QLD, 4303ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

/BT-DO-HR6.jpg)

/BT-DO-HR5.jpg)

_1758680457EfP8W.png)

_1756256563JRMCI.png)

_1755568176P3kHr.png)