Overview

Property ID: LA-9729

- Co-Living

- Property Type

- 5

- Bedrooms

- 5

- Bathrooms

- 2

- Cars

- 205

Details

Updated on Apr 11, 2025 at 01:08 pm

| Property Type: | Co-Living |

|---|---|

| Price: | $ 859,000 |

| Land Price: | $ 440,000 |

| Build Price: | $ 419,000 |

| Gross Per Week: | $ 1,400 |

| Gross Per Annum: | $ 72,800 |

| Gross Yield: | 8.47% |

| Capital Growth 12 Months: | 2.18% |

| Capital Growth 10 Year Annualised: | 6.58% |

| Vacancy Rate: | 1.01% |

| Property Size: | 205 m2 |

| Land Area: | 350 m2 |

|---|---|

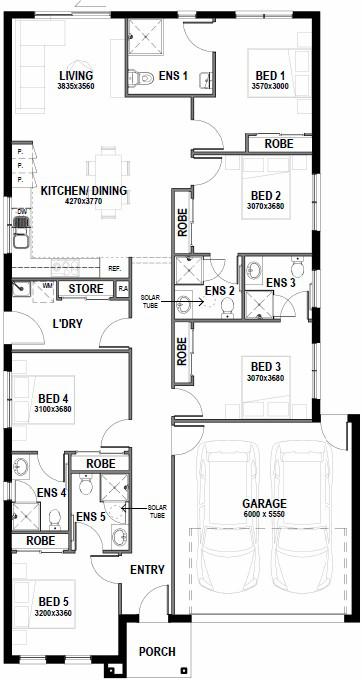

| Bedrooms: | 5 |

| Bathrooms: | 5 |

| Parking: | 2 |

| Title Status: | Titled |

| Property ID: | 9729 |

| SKU: | 1036 |

Description

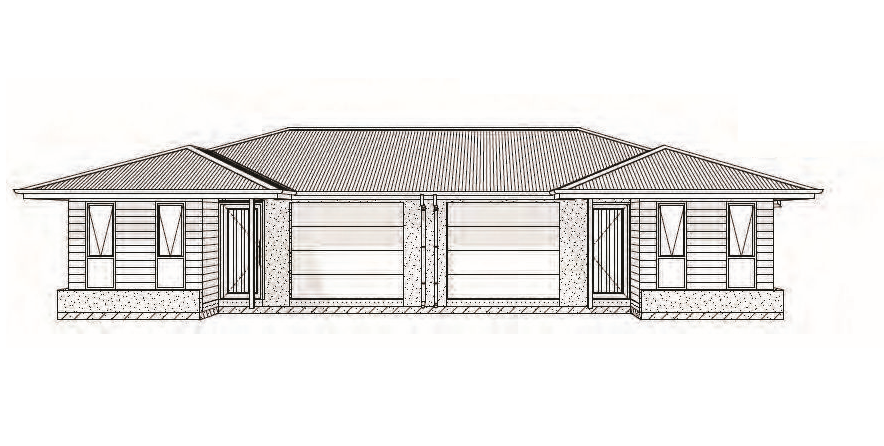

The property is a Co-Living turnkey package featuring five bedrooms, each with private ensuites, providing a unique investment opportunity ideal for shared accommodation. The house includes a modern living area, kitchen/dining space, and double-car garage. Located in the Nelson Village Estate in Cranbourne East, the home boasts a North-facing orientation and offers energy-efficient designs.

Suburb Profile:

Cranbourne East is a rapidly growing suburb in Melbourne's South-East, popular with families and investors. It is well-serviced with schools, parks, shopping centers, and recreational facilities. The suburb enjoys strong infrastructure, proximity to public transport, and ongoing development, making it ideal for long-term growth.

Site Inclusions

- Engineer-designed slab up to P classification

- Stormwater, sewer, water, NBN provision

- Site signage

- Termite treatment

- Rock excavation allowance

- Temporary fencing

Preliminary Inclusions

- Building permits

- Soil test

- Site assessment

- 7-star energy rating report

Internal Inclusions

- 2590mm ceiling heights

- Carpet to bedrooms and laminate timber-look flooring

- 20mm engineered stone benchtops

- Kitchen appliances: 900mm electric oven, cooktop, rangehood, and dishwasher

- Tiled wet areas, semi-framed shower screens, and acrylic bath

- Built-in robes with mirror sliding doors

External Inclusions

- Concrete roof tiles

- Rendered façade and brickwork

- Programmable entry lockset with PIN code

- Colorbond garage door with remote

Landscaping Inclusions

- Turf to front and rear gardens

- Coloured concrete driveway

- Drought-resistant planting

- Letterbox and folding clothesline

Electrical Inclusions

- White LED downlights throughout

- Floodlight with sensor outside doors

- TV point, data points, and smoke detectors

Appliance Inclusions

- 900mm stainless steel electric oven, cooktop, rangehood, and freestanding dishwasher

Upgraded Inclusions

- Option to upgrade to multi-head split system for $14,100

Energy Efficiency

- 7-star energy rating

- PV system

Warranties:

- 3-month maintenance and 10-year structural warranty.

This Co-Living property in Nelson Village Estate presents an excellent investment opportunity with its five-bedroom, five-bathroom configuration, premium inclusions, and modern design. Located in the growing Cranbourne East suburb, it offers strong potential for rental income and capital growth.

A co-living property is a type of shared accommodation that offers private bedrooms with ensuite bathrooms and communal spaces such as kitchens, living rooms, dining areas, laundry facilities and outdoor areas.

Co-living properties are designed to foster a sense of community, convenience and comfort among the residents, who can enjoy the benefits of having their own space as well as socialising with like-minded people.

A co-living property attracts tenants who are looking for an affordable, flexible and hassle-free living option that suits their lifestyle and needs.

Co-living tenants are typically young professionals, students, digital nomads, entrepreneurs, creatives and seniors who value convenience, connectivity and collaboration.

A co-living property offers benefits to an investor who is looking for a high-yield, low-risk and future-proof investment opportunity.

Co-living properties have a higher occupancy rate, lower vacancy rate and lower turnover rate than traditional rental properties, as they cater to the growing demand for affordable and flexible housing solutions in urban areas.

Co-living properties also have higher capital growth potential, as they are generally located in prime locations with access to transport, education, employment and entertainment hubs.

You can read more about Co-Living here: https://ausinvestmentproperties.com.au/blogs/co-living-the-future-of-australian-housing

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Documents

Address

Open on Google MapsSimilar Listings

$ TBA

TBA%

6.16%

5.28%

Ellisburg Street, Manor Lakes VIC

Melbourne, VIC, 3024$ TBA

TBA%

6.78%

4.55%

Lot 2025 Cadastral Way, Melton South VIC

Melton, VIC, 3338$ TBA

TBA%

0.00%

10.96%

Lot 1240 International St, Deanside VIC

Melbourne, VIC, 3336$ 72,800

5.60%

7.33%

0.77%

Lot 1/17 George Street, Beenleigh QLD

Logan, QLD, 4207Sold Listings

$ 39,000

5.28%

6.16%

5.28%

Lot S Oski Street, Wyndham Vale VIC (3 beds)

Melbourne, VIC, 3024$ TBA

TBA%

4.59%

11.94%

Lot 2/4 Angle Vale Road, Angle Vale SA

Adelaide, SA, 5117$ TBA

TBA%

7.54%

0.25%

Lot 1/4 Holly Street, Christies Beach SA

Adelaide, SA, 5165$ 72,800

8.00%

7.62%

1.29%

Lot 15 New Road, Goodna QLD

Ipswich, QLD, 4300ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

_1741047172OoCi6.jpg)

_1740445153rAy5I.jpg)

_1739835983Dm3kj.jpg)