_1748483094kMBGy.jpg)

Lot 4 - Bognuda Street - Bundamba

Bundamba, Ipswich, QLD, 4304$ 863,321

Overview

Property ID: LA-14839

- House and Land

- Property Type

- 4

- Bedrooms

- 2

- Bathrooms

- 2

- Cars

- 182

Details

Updated on Jun 09, 2025 at 10:02 pm

| Property Type: | House and Land |

|---|---|

| Price: | $ 863,321 |

| Land Price: | $ 425,000 |

| Build Price: | $ 438,321 |

| Gross Per Week: | $ 725 |

| Gross Per Annum: | $ 37,700 |

| Gross Yield: | 4.37% |

| Capital Growth 12 Months: | 22.01% |

| Capital Growth 10 Year Annualised: | 8.37% |

| Vacancy Rate: | 0.63% |

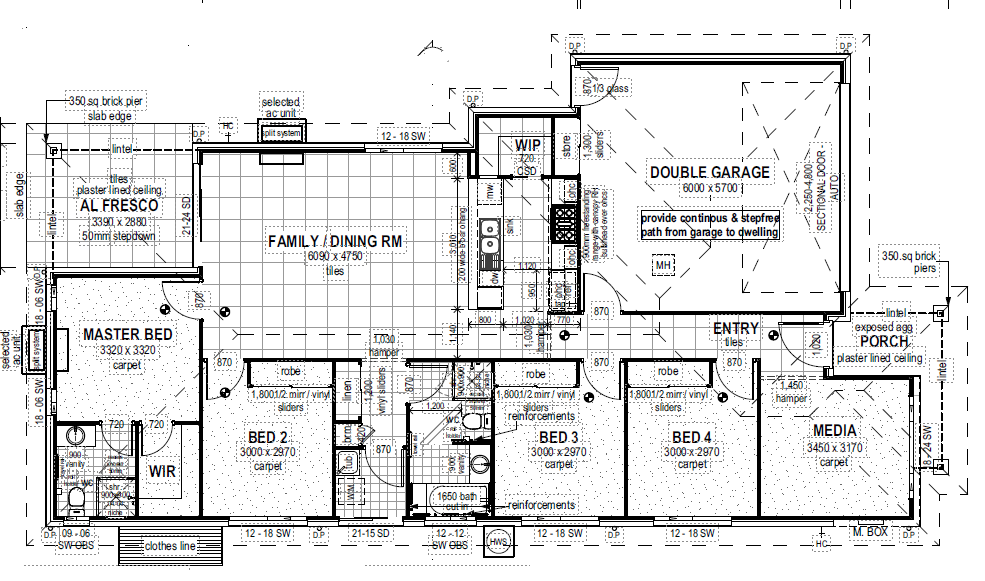

| Property Size: | 182 m2 |

| Land Area: | 810 m2 |

|---|---|

| Bedrooms: | 4 |

| Bathrooms: | 2 |

| Parking: | 2 |

| Title Status: | Registered |

| Property ID: | 14839 |

| SKU: | 1001 |

Description

Bundamba is a suburb located approximately 6.3 km east-northeast of Ipswich CBD and about 35 km southwest of Brisbane CBD. It falls under the jurisdiction of the City of Ipswich and had a population of 6,542 people as of the latest census.

The property market in Bundamba has experienced significant growth. The median house price is approximately $610,000, reflecting an 18.45% increase over the past year. Units have a median price of around $493,500, with a 37.08% annual growth. Houses typically spend about 12 days on the market, while units average 16 days.

In the rental sector, houses in Bundamba have a median weekly rent of $500, yielding an annual rental return of 4.6%. Units rent for about $440 per week, with a rental yield of 5.6%.

Bundamba offers a range of amenities, including several parks such as Bundamba Memorial Park, which features playground equipment, picnic facilities, and public toilets. The suburb is also home to the Ipswich Knights Soccer Club and the Bundamba Swim Centre.

Public transport is accessible via the Bundamba railway station, providing regular services to Brisbane, Ipswich, and Rosewood.

Overall, Bundamba combines a family-friendly environment with strong property market performance, making it an attractive option for homeowners and investors alike.

Disclaimer*

Reservation Requirements:

1. Completed EOI (Property Reservation form under Fusion CRM Online Forms)

2. Holding deposit receipt (amount TBA)

3. Copy of client's finance pre-approval letter/comfort letter from the broker

4. Copy of client's ID

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 37,440

4.11%

7.33%

0.77%

Lot 89 - Yarrabilba Estate - Yarrabilba

Yarrabilba, Logan, QLD, 4207$ 21,216

3.99%

5.84%

2.48%

Lot 1704 - Whiterock - White Rock

White Rock, City of Ipswich, QLD, 4306$ 28,600

4.46%

6.07%

0.49%

Lot 212 - Botanic Estate - Highfields - AUD 75...

Highfields , Toowoomba, QLD, 4352$ 29,380

4.11%

6.40%

1.35%

Lot 51 - Farriers Creek Estate - Burpengary

Burpengary, Moreton Bay Region , QLD, 4505Sold Listings

$ 42,120

6.02%

5.55%

2.86%

Lot S1304 Springridge Estate, Wallan VIC

Mitchell Shire, VIC, 3756$ 40,560

4.16%

6.40%

1.35%

Lot S443 South Street, Burpengary East QLD

City of Moreton Bay, QLD, 4505$ 35,620

4.89%

6.10%

1.35%

Unit S16 Lot 18-20 David Street, Burpengary QLD

Moreton Bay, QLD, 4505$ 36,400

4.86%

6.10%

1.35%

Unit S15 Lot 18-20 David Street, Burpengary QLD

Moreton Bay, QLD, 4505ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

_17471056008d4BA.jpg)

_1745456739NdGQu.jpeg)