_1770677325GS4sO.jpg)

Lot 732 Turmeric Street, Tarneit VIC

Tarneit, Melbourne West, VIC, 3029$ 1,121,500

Overview

Property ID: LA-20540

- Rooming House

- Property Type

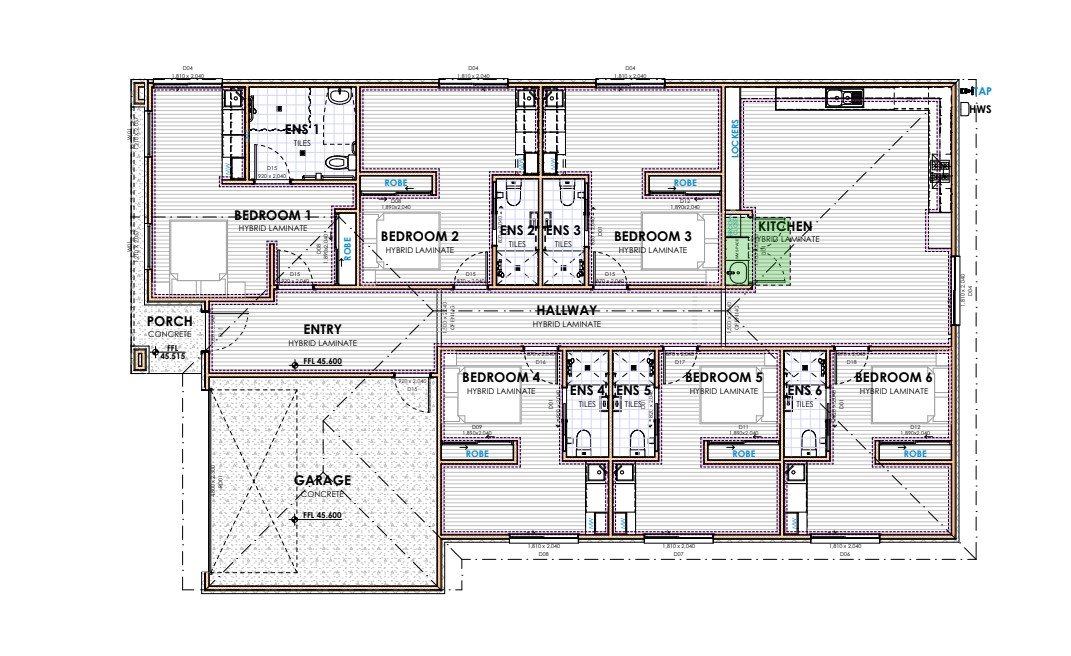

- 6

- Bedrooms

- 6

- Bathrooms

- 2

- Cars

- 240

Details

Updated on Jan 16, 2026 at 10:24 am

| Property Type: | Rooming House |

|---|---|

| Price: | $ 1,121,500 |

| Land Price: | $ 439,500 |

| Build Price: | $ 682,000 |

| Gross Per Week: | $ 1,600 |

| Gross Per Annum: | $ 83,200 |

| Gross Yield: | 7.41% |

| Capital Growth 12 Months: | -0.15% |

| Capital Growth 10 Year Annualised: | 5.86% |

| Vacancy Rate: | 3.04% |

| Property Size: | 240 m2 |

| Land Area: | 400 m2 |

|---|---|

| Bedrooms: | 6 |

| Bathrooms: | 6 |

| Parking: | 2 |

| Title Status: | Q2 2026 |

| Property ID: | 20540 |

| SKU: | 1053 |

Description

Positioned in the sought-after suburb of Tarneit, this Rooming House offers a forward-looking investment opportunity. With 6 bedrooms, 6 bathrooms and 2 car spaces, it blends contemporary design with low-maintenance living. Its modern features appeal to today’s market, while its location supports long-term value growth. Whether you’re expanding your portfolio or stepping into property investment, it’s well suited for future-ready buyers. A property that offers both confidence and opportunity.

Suburb profile:

Tarneit is one of Melbourne’s fastest-growing western suburbs, offering strong infrastructure, schools, and retail amenities. Excellent transport connectivity supports high rental demand and long-term growth.

Inclusions:

- 2700 mm ceiling height

- Keyless lock to main entrance door and all bedroom doors

- Hybrid flooring to bedrooms and living areas

- Tiles to wet areas

- Provide 2340H x 820W front door in lieu of standard

- 1B housing type compliance

- Additional hot water system for additional ensuites

- 10 year structural warranty

- Full turnkey inclusions

- Air conditioner in all bedrooms and living area

- 900 mm cooktop and 600 mm dishwasher in kitchen

This Rooming House in Tarneit is more than just a property — it’s a secure, future-ready investment. Combining location, design and return potential, it makes a valuable addition to any portfolio. A choice that blends stability with opportunity.

Single-person households are on the rise, accounting for a significant 25% of all households in Australia. This trend shows no signs of slowing down, and experts project a continued growth in single-person households, reaching an estimated 3 to 3.5 million over the next two decades. This surge underscores the increasing demand for housing options tailored to individual occupants.

Rooming house properties represent a form of shared accommodation, offering private bedrooms with ensuite bathrooms, and often including living and kitchenette facilities akin to a compact, one-bedroom unit or apartment. These properties appeal to tenants seeking affordable, adaptable, and hassle-free living arrangements that align with their lifestyles and requirements.

Many rooming houses are strategically situated in suburban areas, providing proximity to transportation, shopping centers, restaurants, cafes, and community hubs—making them an enticing choice for tenants.

Typical rooming house tenants encompass young professionals, students, digital nomads, entrepreneurs, creatives, and seniors who prioritize convenience, connectivity, and collaboration.

For investors, rooming house properties offer a compelling value proposition. They present a high-yield, low-risk, and forward-looking investment opportunity. Rooming house properties consistently maintain higher occupancy rates, lower vacancy rates, and reduced turnover compared to traditional rentals. This aligns with the burgeoning demand for affordable and flexible housing solutions in urban settings.

Additionally, rooming house properties often boast higher capital growth potential, given their prime locations with access to transportation, education, employment, and entertainment hubs.

Why are rooming houses so attractive to investors?

- High Demand: Rooms are in high demand, ensuring quick occupancy.

- Higher Yields: Often double compared to the suburb average.

- Diverse Tenant Base: Young professionals and older singles generally seek this accommodation category.

- Tax Depreciation: Benefits from fixtures and fittings.

- Income Security: Steady income flow even when one tenant moves out.

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 122,980

8.22%

7.64%

0.90%

Lot 1192 Bald Hills QLD

Bald Hills, Brisbane, QLD, 4036$ 124,280

8.16%

7.18%

0.59%

Lot 1194 Cleveland QLD

Cleveland, Redland City, QLD, 4163$ 118,560

8.17%

6.82%

0.87%

Lot 1193 Mango Hill QLD

Mango Hill, Moreton Bay, QLD, 4509$ 147,160

8.15%

7.43%

2.26%

Lot 1158 Indooroopilly QLD

Indooroopilly, Brisbane, QLD, 4068Sold Listings

$ 113,360

8.2%

7.40%

0.82%

Lot 1187 Oxley QLD

Oxley, Brisbane, QLD, 4075$ 113,360

8.16%

7.96%

0.67%

Lot 1188 Wellington Point QLD

Brisbane, QLD, 4160$ 121,160

8.19%

7.52%

1.68%

Lot 1182 Coopers Plains QLD

Coopers Plains, Brisbane South, QLD, 4108$ 121,160

8.50%

7.52%

1.68%

Lot 1180 Coopers Plains QLD

Brisbane South, QLD, 4108ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

.jpg)

.jpg)

.jpg)

_17701746679NQAl.jpg)

_176766512377GnS.png)

_1764731815HUFUX.jpg)

_1764211036lHsm6.png)

_1762916285NoFl4.jpg)