_1771381544bNgSb.jpg)

Overview

Property ID: LA-16401

- SMSF Single Contract

- Property Type

- 3

- Bedrooms

- 3

- Bathrooms

- 1

- Cars

- 108

Details

Updated on Aug 21, 2025 at 10:21 pm

| Property Type: | SMSF Single Contract |

|---|---|

| Price: | $ 1,250,000 |

| Land Price: | N/A |

| Build Price: | N/A |

| Gross Per Week: | $ 975 |

| Gross Per Annum: | $ 50,700 |

| Gross Yield: | 4.06% |

| Capital Growth 12 Months: | 9.79% |

| Capital Growth 10 Year Annualised: | 7.10% |

| Vacancy Rate: | 1.50% |

| Property Size: | 108 m2 |

| Land Area: | TBA m2 |

|---|---|

| Bedrooms: | 3 |

| Bathrooms: | 3 |

| Parking: | 1 |

| Title Status: | Titled |

| Property ID: | 16401 |

| SKU: | 1045 |

Description

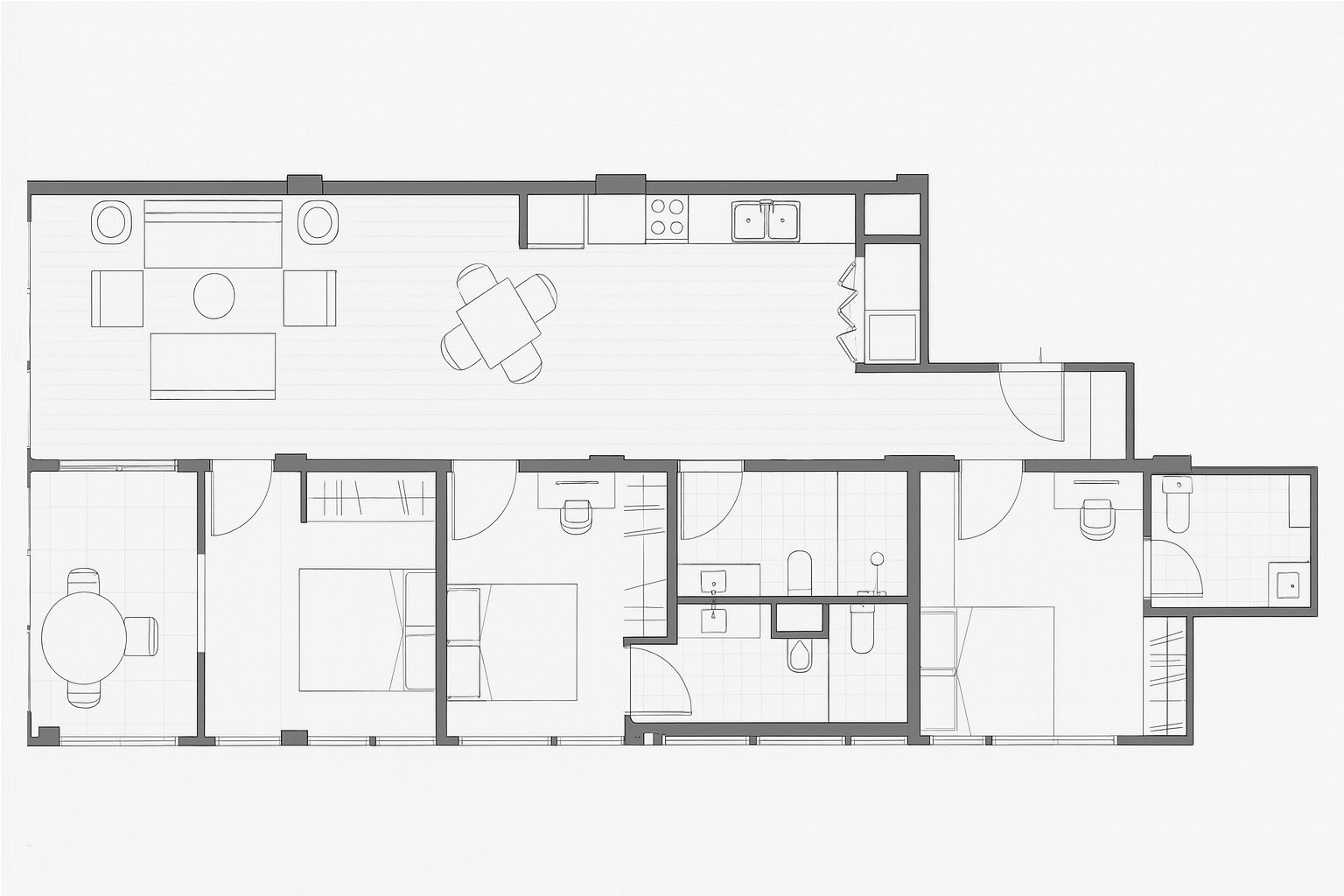

This co-living property in Woolloongabba QLD is a rare completed investment opportunity featuring three bedrooms, each with its own private ensuite. With a total build size of 108m² and premium modern inclusions, this apartment is already furnished, some units leased, and backed by a 3-year rental guarantee. Strategically positioned within walking distance of hospitals, major universities, and The Gabba, it promises strong long-term rental demand. Ideal for SMSF buyers seeking a low-maintenance, high-yield investment in a tightly held urban precinct.

Suburb profile:

Woolloongabba is an inner-city suburb located just 2 km from Brisbane’s CBD, known for its excellent connectivity, vibrant lifestyle, and strong rental demand. The suburb boasts close proximity to top educational institutions, hospitals, and major sporting venues like The Gabba. With ongoing infrastructure upgrades and urban renewal, Woolloongabba continues to attract professionals and students alike. The area's growth prospects and walkability make it a hotspot for savvy property investors.

Inclusions:

- 7 Star Basix energy rating

- Volos premium kitchen inclusions

- 900mm gas cooktop and oven

- 600mm dishwasher

- Featured stone bench top

- Volos bathroom and ensuite fitouts

- Legrand LED lights, switches and electrical fittings

- Bora 2.5kW Hi-Wall inverter AC (Master Bedroom)

- Bora 7.1kW Hi-Wall inverter AC (Living)

- Thermann LPG hot water system

- Hybrid flooring

- 2.55m ceiling height

This co-living property is an ideal SMSF-friendly investment offering a completed, high-yield solution in one of Brisbane's most sought-after suburbs.

A co-living property is a type of shared accommodation that offers private bedrooms with ensuite bathrooms and communal spaces such as kitchens, living rooms, dining areas, laundry facilities and outdoor areas.

Co-living properties are designed to foster a sense of community, convenience and comfort among the residents, who can enjoy the benefits of having their own space as well as socialising with like-minded people.

A co-living property attracts tenants who are looking for an affordable, flexible and hassle-free living option that suits their lifestyle and needs.

Co-living tenants are typically young professionals, students, digital nomads, entrepreneurs, creatives and seniors who value convenience, connectivity and collaboration.

A co-living property offers benefits to an investor who is looking for a high-yield, low-risk and future-proof investment opportunity.

Co-living properties have a higher occupancy rate, lower vacancy rate and lower turnover rate than traditional rental properties, as they cater to the growing demand for affordable and flexible housing solutions in urban areas.

Co-living properties also have higher capital growth potential, as they are generally located in prime locations with access to transport, education, employment and entertainment hubs.

You can read more about Co-Living here: https://ausinvestmentproperties.com.au/blogs/co-living-the-future-of-australian-housing

Disclaimer*

All details shown have been provided by third parties, for full details and inclusions please refer to the land and building contracts.

Address

Open on Google MapsSimilar Listings

$ 37,752

6.00%

6.35%

1.81%

Lot 16 - Co-Living Springleigh Estate - Kilmore

Kilmore, Kilmore, VIC, 3764$ 26,936

4.50%

6.63%

2.20%

Lot 313 - York Street - Geelong

Geelong, Geelong, VIC, 3220$ 26,936

5.88%

6.63%

2.20%

Lot OG14 - York Street - Geelong

Geelong, Geelong, VIC, 3220$ 26,936

4.50%

6.63%

2.20%

Lot 412 - York Street - Geelong

Geelong, Geelong, VIC, 3220Sold Listings

$ 78,000

10.95%

5.77%

1.75%

Bridgewater Cres, Bacchus Marsh VIC

Bacchus Marsh, Moorabool, VIC, 3340$ 59,800

7.8%

5.67%

16.88%

Candytuft Ave, Thornhill Park VIC (Model A)

Thornhill Park, Melton, VIC, 3335$ 61,464

8.22%

5.67%

16.88%

Candytuft Ave, Thornhill Park VIC (Model B)

Thornhill Park, Melton, VIC, 3335$ 55,588

6.96%

5.86%

3.04%

Hoist Dr, Tarneit VIC (Model B)

Tarneit, Wyndham, VIC, 3029ENQUIRE ABOUT THIS PROPERTY

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

.jpg)

.jpg)

.jpg)

_1770677325GS4sO.jpg)

_17701746679NQAl.jpg)

_176766512377GnS.png)

_1764731815HUFUX.jpg)

_1764211036lHsm6.png)