_1770677325GS4sO.jpg)

_1764211036lHsm6-card.png)

What the New Macquarie & Commonwealth Bank of Australia (CBA) Lending Clamp Down Means for Property Investors

Stricter “Company & Trust” Loan Rules Could Change Your Investment Strategy, Here’s What You Need to Know The landscape for property investors in Australia is shifting. From 22nd November 2025 CBA introduced tighter lending rules for non individual borrowers that is, companies and trusts significantly affecting how investors finance property through those structures.

By Aus Investment Properties

By Aus Investment Properties- 2 months ago

- Investment Properties , investment opportunities Australia , CBA company trust lending Real Estate Australia , Aus Investment Properties , Australian Property Investment , Sydney property investors , investment property finance 2025

_17623130443GJfk-card.jpg)

Investor Momentum Returns: What Australia’s Property Market Data Reveals About the Next Growth Phase

New data shows both investors and first-home buyers are re-entering the market. Behind the headlines lies a shift in financial conditions, lending trends, and structural supply issues shaping investor opportunity. After a period of relative stagnation, Australia’s property market is showing renewed strength. Recent figures confirm national home values rose by 1.1 per cent in October and 6.1 per cent over the past year, the most pronounced annual lift in more than two years.

By Aus Investment Properties

By Aus Investment Properties- 3 months ago

- Investment Properties , Real Estate , Australia Property Market Real Estate Australia , Aus Investment Properties , Australia's Property Market Forecast , Australian Property Investment

_1760408926gJ50A-card.jpg)

Bridging the Gap: How Australia's Housing Shortage Presents a Golden Opportunity for Property Investors

Don't just observe the housing crisis – leverage it. Understand how Australia's unprecedented dwelling deficit could be the catalyst for your next successful investment. Australia is grappling with a significant housing shortage, a topic dominating headlines and impacting individuals across the nation. While the human element of this crisis is undeniable, for astute property investors, it also presents a compelling, long-term opportunity.

By Aus Investment Properties

By Aus Investment Properties- 3 months ago

- Investment Properties Real Estate , Investment Properties , Real Estate Australia , Aus Investment Properties , Australian Property Investment

_17598783571Kaml-card.jpg)

October 2025 Quarterly Property Report

October 2025 shows a mixed picture. The national average build price per m² eased to $2,387.33 per m², down -7.51% from $2,581.17 per m² in July. At a property type level, Dual Occupancy recorded the strongest average at $3,120.87 per m² and rose +7.27% on July, while Co-Living and House and Land were broadly flat to slightly lower. Variations by state were material, with VIC Dual Occupancy rising sharply and WA Co-Living also lifting.

By Aus Investment Properties

By Aus Investment Properties- 4 months ago

- Investment Properties , Quarterly Report

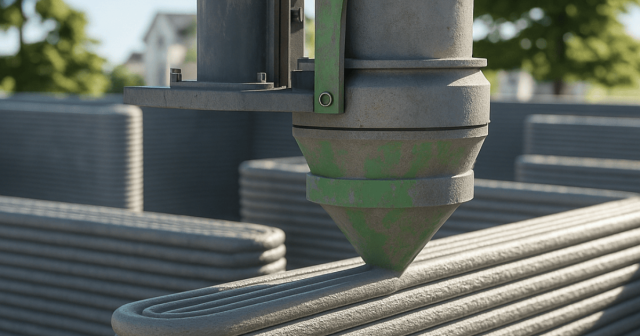

3D Printed Homes, The Future of Housing and the Answer to Australia’s Housing Shortage?

How innovation in construction could reshape affordability, sustainability, and investment opportunities Australia’s housing market faces ongoing challenges, rising construction costs, supply shortages, and an affordability crisis impacting both buyers and renters. For investors, these conditions can slow down projects, push up costs, and reduce yields. But an emerging innovation could help change the landscape, 3D printed homes.

By Aus Investment Properties

By Aus Investment Properties- 5 months ago

- Co-Living Properties , Investment Properties , Real Estate Real Estate Australia , Australian Housing 2025 , 3D printed homes Australia

_1751940993PbDjZ-card.jpg)

Australia’s Property Listings Slide Further – What This Means for Investors in 2025

As demand surges and stock tightens, investors are turning to high-yield strategies. Australia’s property market continues to tighten, with the latest June 2025 figures from SQM Research revealing an 8.8% monthly drop in total residential property listings. This shift reflects more than just a seasonal trend—it signals a growing imbalance between housing supply and demand across the country.

By Aus Investment Properties

By Aus Investment Properties- 7 months ago

- Investment Properties , Real Estate , Australia Property Market Investment , Property , Investment Properties , Australia Real Estate

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

_17701746679NQAl.jpg)

_176766512377GnS.png)

_1764731815HUFUX.jpg)

_1764211036lHsm6.png)

_1762916285NoFl4.jpg)