_176766512377GnS.png)

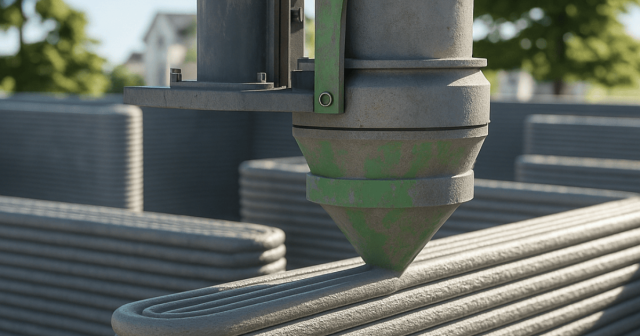

3D Printed Homes, The Future of Housing and the Answer to Australia’s Housing Shortage?

How innovation in construction could reshape affordability, sustainability, and investment opportunities Australia’s housing market faces ongoing challenges, rising construction costs, supply shortages, and an affordability crisis impacting both buyers and renters. For investors, these conditions can slow down projects, push up costs, and reduce yields. But an emerging innovation could help change the landscape, 3D printed homes.

By Aus Investment Properties

By Aus Investment Properties- 4 months ago

- Co-Living Properties , Investment Properties , Real Estate Real Estate Australia , Australian Housing 2025 , 3D printed homes Australia

_1751333432LuNFZ-card.jpg)

Aus Investment Properties Quarterly Report – July 2025

Australian Turn-Key Investment Property Building Costs Per Square Metre. Overview: As of July 2025, the national average build cost across all turnkey investment property types has continued to rise, reflecting ongoing supply chain pressures, increased labour costs, and strong investor demand. This report breaks down the average build price per square metre for key investment property types across Australia, compared with March 2025 data.

By Aus Investment Properties

By Aus Investment Properties- 6 months ago

- Co-Living Properties , Investment Properties , SDA Properties , SMSF Investment Properties , Investment , Quarterly Report SDA Properties , Real Estate , Co-Living , Dual Occupancy , Duplex , Investment Properties , Australia Real Estate , Real Estate Australia , Investors , Quarterly Report

_1741047172OoCi6-card.jpg)

Unlocking High-Yield Opportunities: The Rise of Shared Living Investments in Australia - The Future of Housing Investment

Australia’s property market is evolving, and shared living is emerging as a game-changing investment opportunity. This innovative housing model provides a solution to the nation’s housing affordability crisis while offering investors a lucrative avenue for high rental yields and low vacancy rates.

By Aus Investment Properties

By Aus Investment Properties- 10 months ago

- Co-Living Properties , Investment Properties , Real Estate , Rooming Houses Co-Living , Investment Properties , Real Estate Australia , Aus Investment Properties , Rooming House , Shared living

_1733277392erPK8-card.jpg)

Unlocking Regional Investment Potential

A Surge in Migration Trends for Australian Property Investors The Regional Movers Index (RMI) September 2024 report highlights a fascinating shift in Australia’s internal migration patterns, presenting an enticing opportunity for property investors. With a growing trend of individuals and families moving from capital cities to regional areas, the regional property market is brimming with potential.

By Aus Investment Properties

By Aus Investment Properties- 1 year ago

- Co-Living Properties , Investment Properties , SMSF Investment Properties Investment , Real Estate , Investment Properties , Australia Real Estate , Investment Goals , Real Estate Australia , Aus Investment Properties

‘Aus Investment Properties’

We are excited to introduce ‘Aus Investment Properties’Australia’s #1 Investment Property Portal! Whether you’re a seasoned investor or exploring the world of property investment for the first time, our mission is simple: ‘Aus Investment Properties’ helping everyday Australians secure their financial future through property investing!

By Aus Investment Properties

By Aus Investment Properties- 1 year ago

- Co-Living Properties , Investment Properties , SDA Properties , Real Estate , SMSF Investment Properties , Investment , Rooming Houses , SMSF Single Contract

What is a Co-Living Property and Why You Should Seriously Consider Adding One to Your Portfolio or SMSF?

Co-living homes deliver up to 80% more income than a standard investment property. A co-living property is a type of shared accommodation that offers multiple private master bedrooms with ensuite and shared communal areas. Each room is rented out separately to individuals and is managed by a specialised property manager. A Co-living home is purpose-built and looks and feels like a regular home but with upgraded features and design.

By Aus Investment Properties

By Aus Investment Properties- 1 year ago

- Co-Living Properties , Investment Properties , Real Estate Investment , Co-Living , Real Estate , Investment Properties

Why Buy With Aus Investment Properties?

- Dedicated In-house Project Manager.

- High-yielding properties.

- Independent rental assessment.

- Full turnkey properties, 'Ready to Rent'.

- Brand new properties with builders warranty.

- High quality, highly specified properties.

- Tax and depreciation benefits from new properties.

- Buy direct from the builder.

- Investor or SMSF.

Search 1000'S Of Off-Market Investment Properties!

SQM Research is an investment research house that specialises in providing accurate research and data to financial institutions, investment professionals and investors.

Aus investment Properties has partnered with SQM Research to provide data across our site to assist investors in making an informed decision.

Capital Growth 12 months, measures the increase in a property’s value over the previous 12 months, indicating how much the investment has appreciated in that timeframe.

Capital Growth 10-year annualised, reflects the average annual increase in a property’s value over the last decade, smoothing out short-term fluctuations to show long-term appreciation trends.

Vacancy Rate, indicates the percentage of properties that are currently unoccupied in that postcode, It’s a key indicator for investors to assess the rental demand.

SMSF Property Investing, when investing inside your SMSF there are some restrictions on how you can purchase investment properties. We use the following information to help navigate the SMSF investment property options.

This property is a single-contract property suitable for an SMSF.

_1764731815HUFUX.jpg)

_1764211036lHsm6.png)

_1762916285NoFl4.jpg)

_17623130443GJfk.jpg)

_1760408926gJ50A.jpg)